CS John Mbadi Defends Ruto Policies: Why Kenyans Are Not Overtaxed

Mbadi argued that the current tax regime was not straining Kenyans' pockets as critics suggested, particularly for the middle class.

National Treasury and Planning Cabinet Secretary John Mbadi recently explained the inner workings of the government's tax policies, denying the narrative that Kenyans were being overtaxed.

Mbadi, who was present during the National Assembly Mid-Term Retreat in Naivasha on Friday, January 31, argued that the current tax regime was not straining Kenyans' pockets as critics suggested, particularly for the middle class.

Breaking down the tax implications for a middle-income earner, the CS revealed that the introduction of the Housing Levy and Universal Health Care deductions was perceived as excessive taxation, though this was not the case.

Mbadi explained that a Kenyan earning Ksh60,000 per month, .a salary bracket often associated with Kenya’s middle class, would only have Ksh2,550 deducted for the Housing Levy and Social Health Authority contributions, whose introduction he claimed were misinterpreted as excessive taxation.

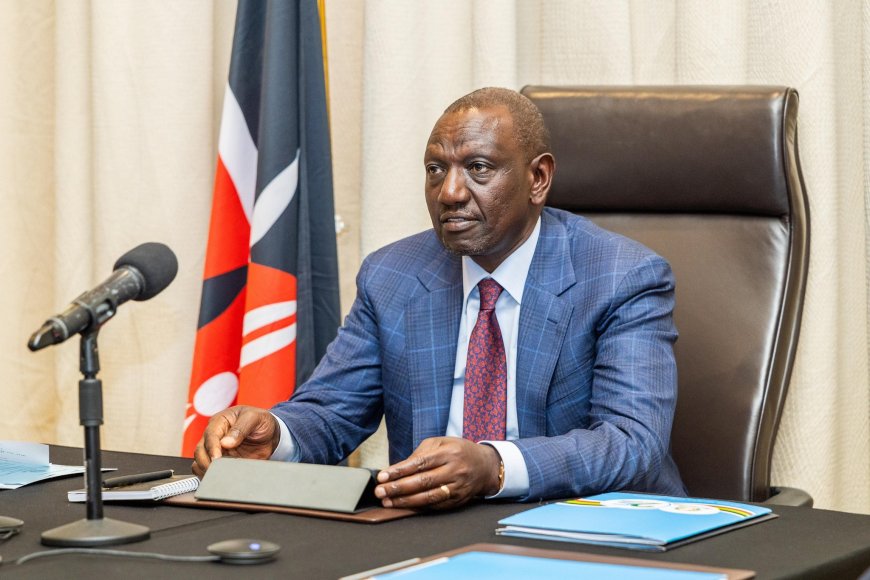

President William Ruto during a virtual Extra-Ordinary Summit of the EAC Heads of State on DRC on January 29, 2025. /PCS

“So, now, I am not in the opposition. I am at the centre of government. I am the minister of finance. So, how do you expect me again to start talking about the negatives? It's not possible. I have to talk about the positives. And by the way, can I just give you an example? You know, there is this thing of saying that we are overtaxing.

"I have looked at the taxes because I was trying to see how I could make the payslips better. So, I have looked at it and please look at this with me. If you are earning 60,000, 60,000, those who are hurt by the taxes are those that Kenyans may call earn super-salary, but when you start adding it, you don't see it as super. But the middle class, not so much. Let's take 60,000 for example,” Mbadi stated.

He highlighted that without these deductions, individuals would still be required to contribute 30 percent of their income to other taxes. However, under the new amendments, this 30 percent remains intact, with the only reduction being 70 percent of the Ksh2,550, amounting to Ksh1,785.

Mbadi also compared the current deductions to the previous National Hospital Insurance Fund (NHIF) contributions, pointing out that someone earning Ksh60,000 previously paid Ksh1,700 per month.

“When you remove that from the Ksh1,785, you are only paying Ksh85 more. Is that over-taxation?” he posed to the lawmakers.

Mbadi's comments came amid growing concerns among Kenyans about the state of the economy and the rising deductions from their salaries.

Recently, Kenyans faced another financial adjustment after the National Social Security Fund (NSSF) announced a six percent increase in employee contributions, with employers required to match the amount. Starting February 1, the minimum contributions will rise from Ksh420 to Ksh480, while high-income earners will see their payments increase from Ksh2,160 to Ksh4,320.

Critics have accused President William Ruto’s administration of overburdening citizens with multiple levies, including the contentious Housing Levy and Social Health Authority (SHA) deductions introduced under the 2023 Finance Act.

However, Mbadi argued that claims of over-taxation have been exaggerated and encouraged Kenyans to assess the figures objectively.

“Those of us in government will now expose this narrative so that people can understand that it is not as bad as it is being portrayed,” he said.