EPRA Lowers Fuel Prices For 2 Products

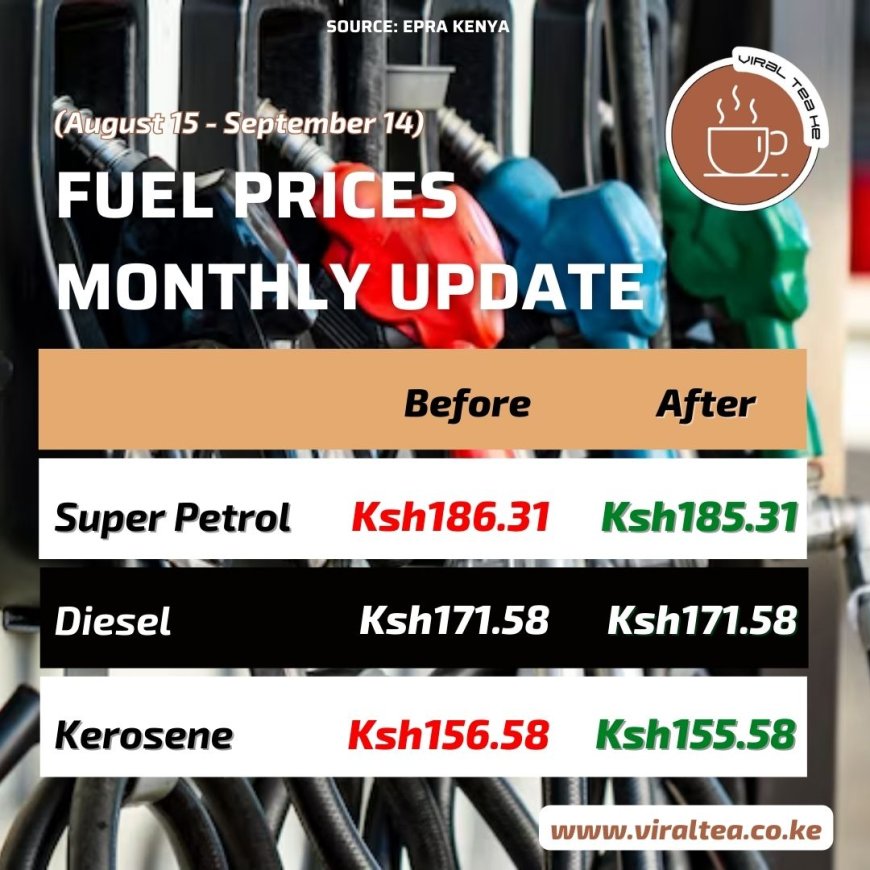

Last month, the prices read as follows: Super Petrol, Diesel and Kerosene at Ksh186.31, Ksh171.58 and Ksh156.58 respectively.

The Energy and Petroleum Regulatory Authority (EPRA) has announced the new prices of Super Petrol, Diesel, and Kerosene fuel products for the upcoming month, set to take effect at midnight tonight.

In its latest review on Thursday, August 14, the regulator announced that whereas the price of Diesel remains unchanged, the prices of Super Petrol and Kerosene have dropped by a shilling.

"In accordance with Section 101(y) of the Petroleum Act 2019 and Legal Notice No.192 of 2022, we have calculated the maximum retail prices of petroleum products which will be in force from 15th August 2025 to 14th September 2025," the statement read in part.

"During the review period, the maximum allowable pump prices for Super Petrol and Kerosene have each decreased by Ksh1 per litre, while the price of Diesel remains unchanged."

Super Petrol and Kerosene will now retail at Ksh185.31 and Ksh155.58 for the period between Friday, August 15 and Sunday, September 14. Last month, the prices read as follows: Super Petrol, Diesel and Kerosene at Ksh186.31, Ksh171.58 and Ksh156.58 respectively.

The revised fuel prices now include a 16 per cent Value Added Tax (VAT), in accordance with the Finance Act 2023, the Tax Laws (Amendment) Act 2024, and the inflation-adjusted excise duty rates outlined in Legal Notice No. 194 of 2020.

According to EPRA, the landed cost of imported super petrol fell by 0.73 per cent, from $628.30 (KSh 81,201) per cubic metre in June 2025 to $623.71 (KSh 80,608) per cubic metre in July 2025.

In contrast, the average landed costs of Diesel and Kerosene rose by 3.08 per cent and 3.20 per cent, respectively, over the same period.

A recent bulletin from the Central Bank of Kenya (CBK) had already signalled a decline in global oil prices, noting that Murban crude oil prices dropped to KSh 8,871 (USD 68.25) per barrel on August 7, down sharply from KSh 9,550 (USD 73.52) a week earlier on July 31.

The fall in international oil prices has been linked to a projected increase in global supply, which has shifted market sentiment and eased concerns over tight inventories.