Wetangula: How Foreign Companies Use Africa In Scheme To Earn Millions

Wetangula noted that the merchants claim to be part of different places in Africa which enables them to earn lots of money from other companies participating in carbon trading.

National Assembly Speaker Moses Wetangula gave a shocking expose regarding foreign firms and merchants using Africa as a leeway to earn their millions.

Speaking on Thursday, January 4 during the 27th Conference of Speakers and Presiding Officers of the Commonwealth, Wetangula revealed that the firms fake their locations in Africa to sell carbon credits.

Linking this to a series of court documents, Wetangula noted that the merchants claim to be part of different places in Africa which enables them to earn lots of money from other companies participating in carbon trading.

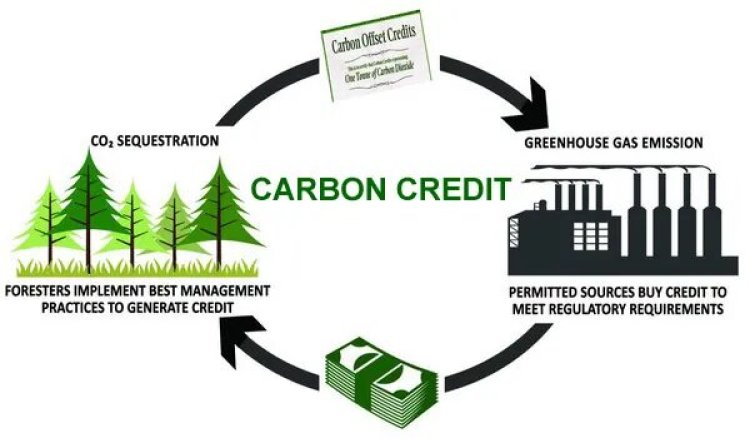

An illustration of how carbon credits work. /FILE

"There is now a big group of merchants all over the world trading in carbon credits. I know where people are earning sums of money out there in Europe, America and other countries using Geo-maps from our continent. People for example will take Congo and pretend to be part of their territory and sell carbon credits," Wetangula stated.

The former Bungoma Senator lamented the lack of regulations and legal frameworks that guide carbon trading, which allow these companies to go unpunished.

He therefore issued a challenge to countries to come up with as well as implement laws that would govern carbon trade.

"So we need to pass laws in our parliaments, particularly in countries that are water and forest secure to protect your heritage," Wetangula maintained.

What are carbon credits?

Carbon credits are a key component of carbon trading, a market-based approach to addressing climate change and reducing greenhouse gas emissions.

The concept is rooted in the idea that entities can earn credits by reducing their greenhouse gas emissions below a pre-established baseline. These credits can then be traded or sold to other entities that may be struggling to meet their emissions targets.

Here's how carbon credits typically work:

-

Emission Reduction Projects: Entities, such as businesses or industries, implement projects that lead to a reduction in greenhouse gas emissions. These projects can take various forms, including renewable energy initiatives, energy efficiency improvements, reforestation efforts, and methane capture projects, among others.

-

Baseline and Additionality: A baseline is established to represent the expected level of emissions without the project. The reduction achieved by the project is measured against this baseline. Additionally, the concept of "additionality" is crucial, meaning that the emissions reduction should be additional to what would have occurred without the project.

-

Verification: An independent third party verifies and certifies the emission reductions achieved by the project. This process ensures transparency and credibility in the carbon credit market.

-

Issuance of Carbon Credits: Once the emissions reductions are verified, carbon credits are issued to the entity responsible for the emission reduction project. Each credit typically represents one ton of carbon dioxide equivalent (CO2e) reduced.

-

Trading and Offsetting: Carbon credits can be traded on the carbon market. Entities that exceed their emissions targets or have a carbon footprint they want to offset can purchase these credits to compensate for their emissions.

-

Compliance and Voluntary Markets: There are two primary types of carbon markets: compliance markets and voluntary markets. Compliance markets are regulated by governments, and entities are often required to purchase carbon credits to meet emissions reduction targets. Voluntary markets, on the other hand, are driven by companies and individuals who choose to offset their carbon footprint voluntarily.

The idea behind carbon credits is to create economic incentives for businesses to reduce their carbon emissions and promote sustainable practices.

However, the effectiveness and ethical considerations of carbon credit systems have been subjects of debate, with critics arguing that they may sometimes allow companies to continue polluting without making substantial efforts to reduce emissions at the source.

In December 2023, President William Ruto dismissed reports of Kenya selling its land to carbon credit companies, particularly reports that Dubai-based firm Blue Carbon signed a framework of collaboration (FOC) with Kenya’s State Department of Environment and Climate Change that would see the government concede millions of hectares of its territory for the production of carbon credits.

“As I talk to you, the regulations are on their way to Parliament. We managed to change the law and, if you remember, I signed the new amendments to the new law about a month and a half ago before the Africa Climate Summit, and now we are working on the regulations because we want to bring integrity into the whole carbon space, from carbon pricing to carbon markets,” the President told the Nation.

“And we have agreed as a continent, and the World Bank by the way is now leading the way in making sure that we finally end up with integrity and standards on carbon trading.”