National Assembly Majority Leader Kimani Ichung'wah has raised national eyebrows by confessing that Parliament silently approved the Finance Bill 2024 back in December, only months after protests against it turned deadly.

While speaking at a church service at PCEA Kikuyu on Sunday, June 22, Ichung’wah explained that the government made the move after realising many Kenyans were firmly buying into what he called "propaganda" about the bill circulating on social media.

"We tried to enlighten them, but they did not listen to us. Finally, we decided not to pass it until people cooled down," he stated.

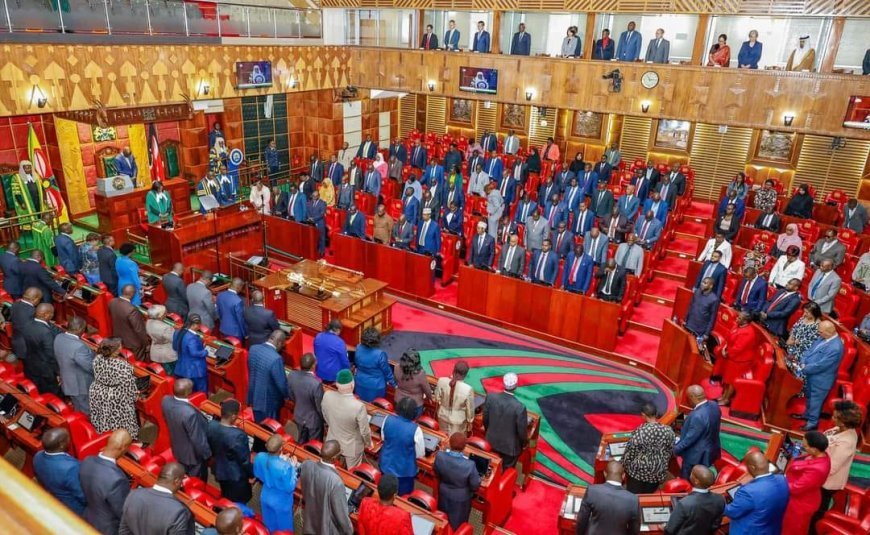

Inside the National Assembly during a past sitting. /PARLIAMENT KENYA

"For your information, because not many people know this, on June 25, we decided not to sign it in. On December 4, 2024, only five months later, everything that was in the finance bill was passed quietly, without any deaths or throwing stones, until 97 per cent of it passed."

Ichung’wah said the 3% of the bill that was rejected stemmed from earlier amendments made before Kenyans began rallying behind the "Don't amend, reject" slogan.

He defended the government’s move, saying it was made in the best interest of the public. According to him, Kenyans were largely misled, especially on claims that the bill would tax diapers and sanitary pads.

He clarified that the taxes only applied to imported products, not locally made ones, arguing this would boost Kenyan manufacturing and create jobs for youth.

Ichung’wah also stated that since implementation began, the government had collected about Ksh187 billion in tax revenue by May of the 2024/2025 financial year. This cash injection, he claimed, has helped revive stalled development projects.

Initially, the Finance Bill 2024 was expected to raise Ksh 346 billion by June; however, due to delays in enforcement between June and December, the government lost approximately Ksh 160 billion.

In December, Parliament passed two new laws—the Tax Laws (Amendment) Bill 2024 and the Business Laws (Amendment) Bill 2024—both introduced via the Office of the Majority Leader. According to Ichung’wah, these were a toned-down alternative to the highly controversial Finance Bill 2024, which had been scrapped following deadly protests that left over 50 people dead.

The new legislation reveals that the 1.5% Digital Service Tax and the 6% Significant Economic Presence (SEP) tax originally proposed have been replaced by a single, less aggressive SEP tax of approximately 3%.

Controversial parts of the original bill—like the 16% VAT on essentials such as bread, eggs, and cooking oil, as well as the motor vehicle tax and eco-levies on items like diapers and smartphones—were dropped in the December revisions.

The Tax Laws Amendment Bill shifted focus to more technical reforms, like raising pension deduction caps, exempting affordable housing contributions, and introducing a 15% global minimum corporate tax for multinational companies.

It also reinstated withholding tax policies with clearer compliance rules and steeper fines, including a 10% penalty for late payments.

Meanwhile, the Business Laws Amendment Bill focused mostly on updating laws around Special Economic Zones and modernising the Employment Act, signalling a more cautious and deliberate fiscal approach by the government.

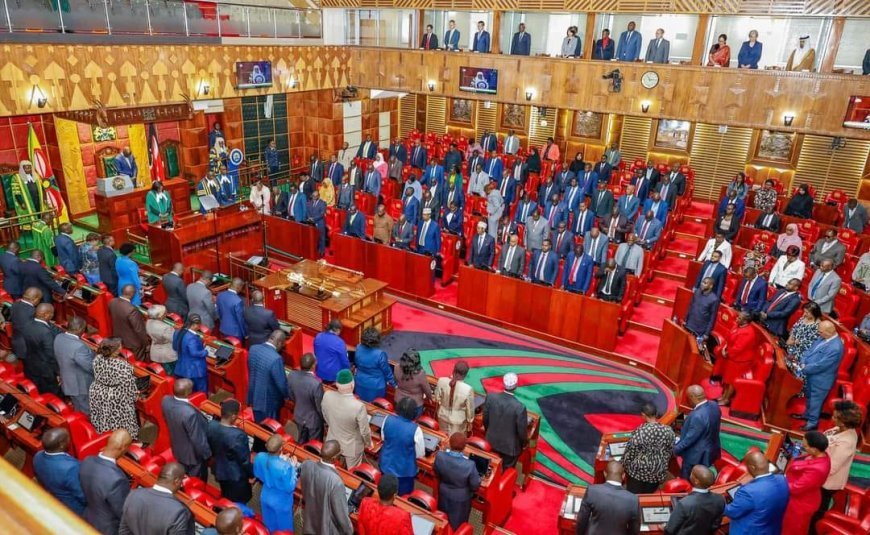

People attend a demonstration against Kenya's proposed finance bill in Nairobi, Kenya, June 25. /REUTERS