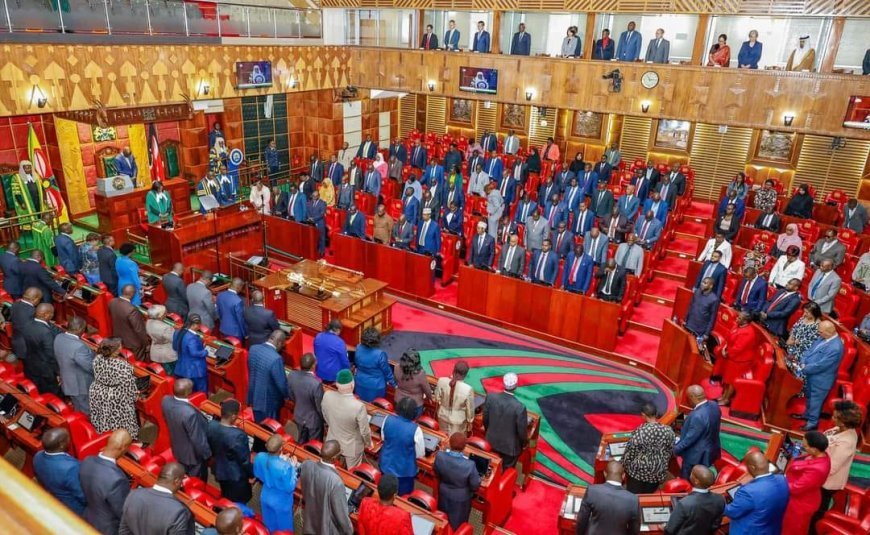

MPs Pass Finance Bill 2025 Without Controversial Proposal

The bill, projected to generate Ksh24 billion in revenue and less controversial than the deleted 2024 version, will be forwarded to President William Ruto for assent into law.

The National Assembly has passed the Finance Bill 2025. However, Members of Parliament (MPs) opted to delete a controversial clause that would have given the Kenya Revenue Authority (KRA) unchecked access to personal customer data; welcome news for Kenyans.

The bill, projected to generate Ksh24 billion in revenue and less controversial than the deleted 2024 version, will be forwarded to President William Ruto for assent into law (it becomes an Act).

MPs approved key amendments from the Finance and Planning Committee, led by Molo MP Kimani Kuria, which dismissed the KRA’s push for blanket access to individuals’ data, citing constitutional privacy protections under Article 31(c) and (d).

The committee noted that the current law — specifically Section 60 of the Tax Procedures Act — already allows data access via court-issued warrants.

Treasury Cabinet Secretary, John Mbadi at his office on August 8, 2024. /NATIONAL TREASURY

The government had in this Finance Bill wanted to scrap Section 59A(1B) of the Tax Procedures Act — a clause that currently blocks KRA from accessing trade secrets or customer personal data. If this proposal had gone through, KRA would have gained the authority to require businesses to hand over detailed transactional data.

The current law protects businesses from being forced to link their systems with KRA if it risks exposing sensitive information. Removing this safeguard would have given KRA full access to business systems in the name of enforcing tax compliance.

This is akin to a proposal that was made in the deleted Finance Bill 2024, which sought to allow KRA to access sensitive personal data, including property and bank account details, in its fight against tax evasion. Former Treasury Cabinet Secretary Njuguna Ndung’u had sought to amend the Data Protection Act, 2019, via the Finance Bill 2024, which would have granted KRA unrestricted access to information from various entities without a court warrant.

This amendment would have integrated data from banks, telecoms, utilities, schools, land registries, and other agencies into KRA's digital system, iTax, sparking concerns among legal experts.

Parliament also dismissed proposed changes to Pay As You Earn (PAYE) tax bands that would have introduced five new brackets: 10%, 17.5%, 25%, 27.5%, and 30%. MPs opposed giving National Treasury Cabinet Secretary (CS) John Mbadi the authority to adjust these rates by up to 10% every three years to account for inflation.

Additionally, MPs rejected the Treasury's attempt to shift several items from zero-rated to tax-exempt status. They opted to keep zero-rated tax status for essential goods like locally assembled phones, motorcycles, electric bicycles and buses, solar batteries, animal feed components, and bioethanol stoves.

Lawmakers also blocked a move to scrap the 15% corporate tax incentive for companies assembling motor vehicles or building at least 100 housing units.

The Ksh500-per-litre excise duty on Extra Neutral Alcohol (ENA) will remain unchanged for licensed spirit manufacturers, giving some breathing room to an industry already burdened by rising taxes.

In a win for retirees, MPs endorsed full tax exemptions on pension payouts, whether paid in lump sums or over time, and repealed overlapping tax rules to streamline clarity.

On digital taxation, they agreed to expand the scope of the Significant Economic Presence Tax (SEPT) to include not just digital marketplaces but also websites and electronic platforms.

However, they rejected a proposed Ksh5 million revenue threshold, warning that it could allow tax evasion and weaken enforcement.