Ruto Appoints Retired CEO To Chair Hustler Fund Board

Olaka is set to hold the post for three years as indicated in a Gazette notice communicating his appointment.

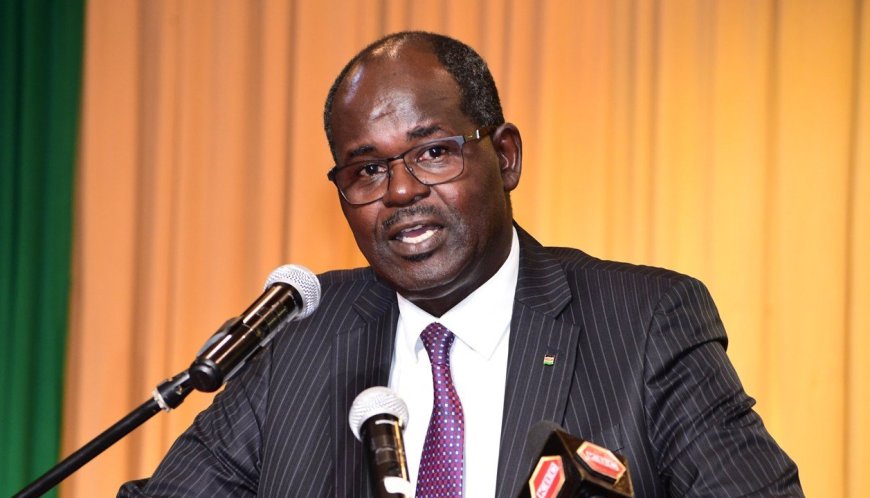

President William Ruto on Friday, February 21 appointed Habil Olaka as the new non-executive chairperson of the advisory board of the Financial Inclusion Fund, popularly referred to as Hustler Fund.

Effective immediately, Olaka is set to hold the post for three years as indicated in a Gazette notice communicating his appointment. He beforehand served as the Chief Executive Officer (CEO) of the Kenya Bankers Association (KBA) until his retirement in March 2024.

“In exercise of the powers conferred by Regulation 10 (1) (a) of the Public Finance Management (Financial Inclusion Fund) Regulations, as read together with Section 51 (1) of the Interpretation and General Provisions Act, I, William Samoei Ruto, President of the Republic of Kenya and Commander-in-Chief of the Defence Forces, appoint— Habil Olaka (Dr.) to be the Non-Executive Chairperson of the Advisory Board of the Financial Inclusion Fund, for a period of three (3) years, with effect from February 21, 2025,” the gazette notice reads in part.

Habil Olaka, who has been appointed the new non-executive chairperson of the advisory board of the Financial Inclusion Fund, popularly referred to as Hustler Fund. /STRATHMORE LAW

This appointment meant that President Ruto revoked the tenure of Irene Muthoni Metha Karimi, who had held the position since the launch of the Hustler Fund in January 2023. Muthoni had originally been appointed for a three-year term.

Olaka’s tenure at the Kenya Bankers Association established him as a significant figure in the nation’s banking sector. The KBA announced his retirement in March 2024 after 14 years of service.