How Fuel Could Cost Up To Ksh200 After MPs Increase VAT to 16%

184 MPs voted in favour of the increase in VAT to 16 per cent against 88 who opposed the amendment

Kenyans are less than a month away from being hit with more nightmares after Members of Parliament (MP) on Wednesday, June 21 approved the increase of fuel's Value Added Tax (VAT) from 8 per cent to 16 per cent.

Following a heated debate between Azimio and Kenya Kwanza MPs in the House, 184 MPs voted in favour of the increase in VAT to 16 per cent against 88 who opposed the amendment, setting the stage for what could see the cost of fuel rise by more than Ksh10.

"A total of 272 members took their votes. Those who voted in favour were 184 and those who opposed were 88," Gilgil MP Martha Wangari, who presided over the session, announced after the conclusion of the vote.

Kitui Central MP Makali Mulu who had moved an amendment to have the Clause on increasing VAT on fuel deleted from the Finance Bill 2023, argued that anytime VAT of fuel is increased, it results in higher costs of transportation, manufacturing, production as well as electricity.

The National Assembly in session on June 14, 2023. /PARLIAMENT OF KENYA

How Will 16% VAT Affect Fuel Prices?

The extra 8 per cent VAT on fuel is likely to have an adverse effect, especially on fuel price per litre, national revenue and cost of essential household products.

The Parliamentary approval is likely to see petroleum products such as petrol, diesel and kerosene be the first affected by the price increase, with the 8 per cent equivalent to approximately Ksh15, which would be added to the cost of petrol, provided that other factors of supply and demand stay constant.

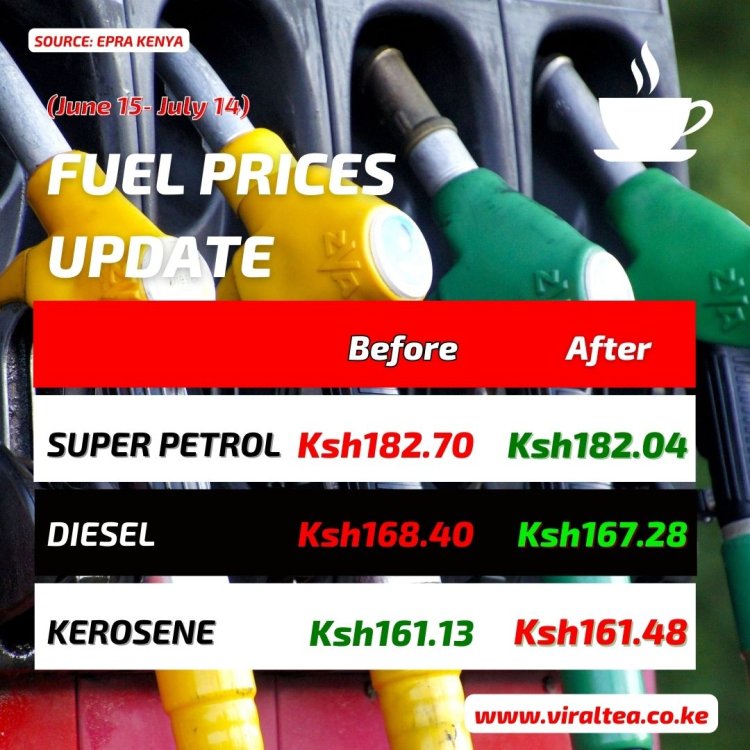

Regarding the fuel price, owing to the current Energy and Petroleum Regulatory Authority (EPRA) prices for the month of June-July among other factors to be taken into consideration while setting new prices, the cost of Super Petrol would likely go from Ksh182.4 in Nairobi to Ksh196.992 by July 2023 and subsequently might shoot to more than Ksh200 in the coming months.

Diesel, on the other hand, which at the moment goes for Ksh167.28 will increase by 8 per cent (Ksh13.3824) to around Ksh180.6624 per litre at fuel stations in Nairobi. Kerosene which retails at Ksh161.48 will increase by 8 per cent (Ksh12.9184) more to Ksh174.3984 at fuel stations in the capital.

With the additional eight per cent, the increased fuel prices may trigger a ripple effect in terms of the cost of living, with matatu fares among others increasing in the days that follow the announcement of monthly fuel prices by EPRA.

The increase in VAT is just one of the many factors to be taken into consideration with regard to fuel prices in the country. Other factors to be considered include the global oil price and the exchange rate, which could have a varied effect.

16% VAT's Benefits To Ruto Govt

It might be argued that the increase in VAT comes as a boost to the State in terms of generating more revenue, estimated at Ksh50 billion, which President William Ruto had assured would be used to rehabilitate roads.

"We are going to increase the VAT by 8 per cent for two reasons number one because having differential rates one at 8 per cent, others at 16 per cent poses an integrity problem, people use it as a loophole to manipulate numbers.

"This 8 per cent that we are adding is going to give us about Ksh50 billion it will begin to deal with the problem of roads across the country," Ruto stated during a joint media interview at State House.

Even though EPRA for the month of June-July reduced the price of Super Petrol and Diesel decreased by Ksh0.66 per litre and Ksh1.12 per litre, the price of Kerosene increased by Ksh0.35 per litre and players in the fuel sector fear that the trend could see Kenyan motorists pay above Ksh200 per litre of fuel.

New fuel prices as announced by EPRA on June 14, 2023. /VIRALTEAKE

As a result, this could either force matatu operators to hike fares or force them to switch to electric buses as a cheaper mode of transport, in President Ruto's push to curb environmental pollution. The prices could also force Kenyans to abandon their cars to use public transport more often to reduce traffic congestion.

Moreover, the increase in fuel prices could also enhance Kenya's competitiveness in that sector with those in other countries, which would lead to more investors focusing more on Kenya as a destination for investments.

The impact of the increase in VAT will depend on a number of factors, including the size of the increase, the state of the economy, and the government's use of the additional revenue. This means that if the increase is small in a strong economy, the negative effects would be reduced.

However, a large increase in a weak economy could bring about negative effects which would be catastrophic. On the bright side, President Ruto vowed to eliminate a 3.5 per cent road development levy, 2 per cent of the Import Declaration Fee (IDF), and 8 per cent VAT on gas to lower the cost of living.

The removal of VAT on gas could offer Kenyans cheaper cooking gas and would entice some of them to do away with cooking stoves which rely on Kerosene for fuel, among other uses in their homes.

admin

admin