How Accidental Mobile Transactions Cost Kenyans A Lot Of Money: KNBS Report

According to the report, the victims lost the money after they accidentally sent the funds to known and unknown people.

Kenyans reportedly lost the highest amount of money accidentally through mobile means, according to a report released by the Kenya National Bureau of Statistics (KNBS). This comes amidst an increase in financial fraud in the country as well as reduced spending power owing to the high cost of living.

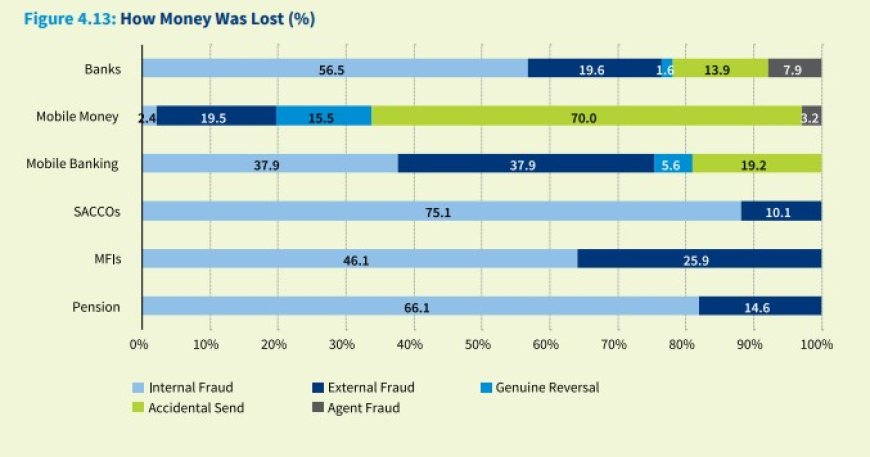

A Finacess report published by KNBS revealed that 70 per cent of Kenyans lost money through accidental mobile money transfer services, the most out of the unintentional ways that Kenyans saw their hard-earned coins disappear.

According to the report, the victims lost the money after they accidentally sent the funds to known and unknown people.

19 per cent of mobile money users disclosed that they lost their money due to internal fraud by money transfer service providers while 15 per cent claimed they lost money through reversals.

Graphic on how Kenyans lost their money on various financial services. /KENYA NATIONAL BUREAU OF STATISTICS

Generally, internal fraud made up the most prevalent cases of money loss, with Savings and Credit Cooperative Organisations (SACCOs) being the major culprits at 75.1 per cent, compared to a mere 10.1 per cent via external fraud, findings that, in a way, point an accusing finger to the internal workings of SACCOs.

Pension schemes were also a notorious form of money loss, with 66.1 per cent via internal fraud and 14.6 per cent external fraud, outlining how Kenyans have fallen prey to conmen while relying on pension schemes.

A pension scheme is a type of long-term savings plan where an employee or worker can save regularly throughout their work life with an expectation of a refund once they retire.

"Regarding money loss, respondents cited various incidences. Internal fraud in SACCOs and pension schemes was the most prevalent at 75.1 per cent and 66.1 per cent, respectively," read the statement in part.

Banks were not spared. 56.5 per cent of Kenyans reported losing money through that channel through internal fraud compared to 19.6 per cent via external fraud. Others cited accidental send, agent fraud and genuine reversal.

46.1 per cent of respondents reported that they lost money through Micro Finance Institutions (MFIs). According to the victims, internal fraud at the MFI led to a massive loss of funds compared to 25.9 per cent who blamed it on external fraud.

Kenyans who depend on mobile banking systems were not left behind, 37.9 per cent of Kenyans who save through mobile banking reportedly lost their money. The victims claimed that they lost their money as a result of internal factors and external factors.

Two weeks ago, a report by the International Criminal Police Organisation (INTERPOL) revealed how Kenyan hackers reportedly made away with Ksh1.1 billion in a massive cybercrime operation this year. A probe conducted by the organisation between September 2 and October 24, 2024, revealed how the hackers stole the funds through fraudulent scripts after altering the banking systems' security protocol.

According to Interpol, after stealing the money, the hackers promptly redistributed it to companies in three countries including the United Arab Emirates (UAE), Nigeria and China. The monies were also channelled to digital asset institutions offering trading and financial services regulated in multiple places. The investigations led to the arrest of almost 24 people.

During the probe, private sector partners, including Internet Service Providers, played a vital role by sharing intelligence, supporting analysis, and disrupting criminal activities, which consequently led to the arrest of the suspects.

The report further revealed that during the same period, security officers across 19 African countries arrested 1,006 suspects and dismantled 134,089 malicious infrastructures and networks.

The arrests dubbed Operation Serengeti, targeted criminals behind ransomware, Business Email Compromise (BEC), digital extortion and online scams. In the operation, more than 35,000 victims were identified, with cases linked to nearly Ksh24 billion in financial losses worldwide.