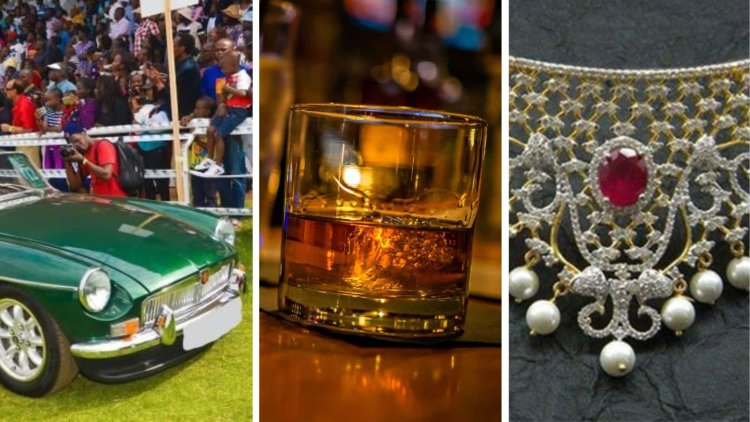

Report Explores Kenyans' Liking For Classic Cars, Whisky, Jewellery

Others include wine preferred by...

Kenya's super-rich are preferring classic cars, jewellery, art, watches, furniture and rare whisky as investments of passion in 2023.

Real estate firm Knight Frank released its 2023 Wealth Report on Wednesday, March 1 showing how Kenyans are taking fewer risks in passion investments compared to coins, despite the rise of non-fungible tokens, and bitcoins among others.

In particular, 50 per cent of Kenyan High Net Worth Individuals (HNWIs) are preferring cars with 45 per cent going for jewellery. 40 per cent of them leaned towards art, 35 per cent preferred watches and furniture, and 30 per cent preferred rare whiskey.

Others include wine preferred by 20 per cent of Kenyan HNWIs, 15 per cent choosing handbags, and the least (5 per cent) inching towards coins and coloured diamonds.

Image of a designer handbag. /FILE

The preference for classic cars points out to a growing motorsport industry in the country, with a series of motorsport events ranging from Concours d'Elegance to the WRC Safari Rally drawing more and more fans to the world of motorsports.

The main reason why Kenya’s super-rich buy investments of passion is for status among peers, followed by the joy of ownership, safe haven for capital, investment portfolio diversification, and capital appreciation.

"The views of respondents to our HNW Pulse Survey are evenly split when it comes to NFTs. Around a third believe they still have potential, while an equal number say they have always been sceptical.

"Interestingly, respondents from the Chinese mainland were more upbeat, with 64% retaining a positive view. They may well be right, although even some of the highest-profile collectors admit that many of the NFTs they have bought are probably worthless," read the report in part.

In addition, Kenya emerged as a preferred destination for the super-rich looking to invest in a new home, with 14 per cent of the African investors expressing interest in investing directly in commercial property in 2023 while 13 per cent noted that they would invest through real estate investment trust (REIT) and debt funding.

Kenya beat the likes of the United Kingdom (UK), United States (US), Canada, South Africa, and Australia among others as countries preferred by Kenyan home buyers, motivated by the increased confidence in Kenya's economic, social and political conditions, even with the new government in place.

In particular, the sectors where they invested include offices (32 per cent), industrial and logistics (32 per cent), retail (68 per cent), residential private rented sector (68 per cent), hotels and leisure (41 per cent), development land (50 per cent) and student housing (23 per cent).

45 per cent of the investors revealed that they leaned towards the agricultural sector, with 36 per cent deciding to pour funds into retirement savings and 27 per cent opting for education.

The report further noted that residential properties were considered the safest and least volatile asset in terms of investments. Cryptocurrencies, equity markets, and commercial properties were considered the most volatile respectively.

Of those considering investing in commercial property, 13 per cent opined that they would spend up to Ksh63 million, and 16 per cent revealed that they would invest up to Ksh127 million. 11 per cent affirmed that they would invest over Ksh2.5 billion in the commercial sector.

"Challenging markets meant the majority of Ultra-High Net Worth Individuals (UHNWIs) saw their wealth decline last year, with their collective wealth falling by 10 per cent (equivalent to Ksh1.2 quadrillion (US$10.1 trillion)," Liam Bailey, Knight Frank's Global Head of Research and Editor-in-Chief of the Wealth Report stated.

A photo of a luxury home. /FILE

admin

admin