5 Ruto Proposals, Directives That Threatened Kenyans' Pockets In 2023

Of particular focus has been the series of taxes fronted by Ruto's administration while being keen on reducing the potential of the payslip

The conversation regarding the high cost of living in the country traversed Kenya's political, social, and entertainment circles, name it...but 2023 has seen President William Ruto's government implement directives and table proposals that have sparked fierce opposition between him and members of the public.

From the doubling of Value Added Tax (VAT) on fuel to the Housing Levy, from the increase in charges of acquiring IDs and passports to the proposed exorbitant increase in charges by the National Transport and Safety Authority (NTSA), the pockets of the ordinary Kenyan earning a source of income have been under constant threat this year.

Of particular focus has been the series of taxes fronted by Ruto's administration while being keen on reducing the potential of the payslip, a matter which has triggered a ripple effect from freezing hirings to mass firings.

We look at the crazy directives and proposals that have threatened the security of your pocket this year:

Housing Levy

Before it was declared unconstitutional by the High Court, the controversial housing development levy contained in the Finance Act, 2023 was fiercely opposed to the point that the government struggled severally to explain why it was deducting 1.5 per cent from all salaried Kenyans in support of President Ruto's Affordable Housing Programme.

An illustration of the Affordable Housing Programme by Boma Yangu Initiative under the National Housing Corporation. /BOMA YANGU KENYA

Employees were to charged a 1.5 per cent tax on their gross salary starting July 2023, with employers expected to match the 1.5 per cent housing deduction with proceeds going towards the National Housing Development Fund (NHDF).

The government expressed commitment to turn the housing challenge into an economic opportunity to create quality jobs. This will be achieved through facilitating the delivery of 250,000 houses per annum and enabling affordable housing mortgages for low-income Kenyans living in urban areas who dreamed of owning a home.

Despite Ruto's complaints, the Housing Levy was nullified by the High Court following a ruling in response to a suit filed by Busia Senator Okiya Omtatah.

The court however granted the government's plea for a 45-day conservatory order regarding the Housing Levy until January 10, 2024, while it rushed to the Court of Appeal to contest the ruling.

Increase in ID, Passport Charges

The government, through Interior Cabinet Secretary (CS) Kithure Kindiki, announced an increase in service fees for key government services. including national identity (ID) cards and passports, with news of the announcement immediately pinching Kenyans where it truly hurts.

The government announced an increase in fees for replacing identity cards from Ksh100 to Ksh2,000 and the fee for first-time ID applicants to Ksh1,000 before it was revised to Ksh300 for first-time applications and Ksh1,000 for those who lose their IDs.

Kenyans seeking to change their particulars in their ID card will be forced to part ways with Ksh1,000 while those seeking identification reports will have to pay Ksh1,000 up from Ksh300, with the proposals set to take effect on January 1, 2024.

The initial proposal also attracted mockery from some Kenyans, giving an example of how a football jersey by an English Premier League (EPL) team sold in the country at scores of jersey shops cost less than the proposed cost of replacing an ID.

It gets worse; the government also raised the fees for ordinary passports from Ksh4,500 to Ksh7,500, for an ordinary 34-page passport. Replacing a lost passport will cost you Ksh20,000 up from Ksh10,000.

"On the particular issue of acquisition of National Identity Cards by previously not registered citizens, the Government shall defray the costs of the revised charges, fees and levies through a waiver for indigent Kenyans who demonstrate inability to pay," stated the CS.

Furthermore, the charges for acquiring a birth certificate were raised from Ksh50 to Ksh200, the same as acquiring a death certificate.

Social Health Insurance Fund (SHIF) Levy

President Ruto had sought to overhaul the National Hospital Insurance Fund (NHIF) by introducing 3 pieces of legislation; The Social Health Insurance Act, the Primary Health Care Act, and the Digital and Digital Health Act.

The Acts, which were assented to law were conceived to help the government achieve Universal Health Coverage in line with the Head of State's legacy plan. The Social Health Insurance Act carried the most significance since this is the one that abolished the National Health Insurance Fund (NHIF) officially for the first time since 1966.

In place of NHIF, Ruto created three funds namely Primary Health Care Fund, Social Health Insurance Fund, and Chronic Illness and Emergency Fund.

The Social Health Bill was to enable all Kenyans to access quality care, regardless of their financial status. Kenyans employed in the formal sector were to make a monthly contribution of 2.75 per cent of their salary capped at a minimum of Ksh300 and a maximum of Ksh5,000.

The fund also proposed a 1.5 per cent levy from salaried individuals and a reduction in contributions from unemployed Kenyans to Ksh300. The Act was suspended by the High Court until February 7, 2024.

NTSA Charges

Kenyan motorists risk digging deeper into their pockets for services from the National Transport and Safety Authority (NTSA) should proposals to increase its service charges go through.

On Monday, November 11, NTSA unveiled the second draft of the Financial Sustainability Study which proposed an increase of services by up to 900% to finance its budget deficit amounting to more than Ksh2.3 billion.

A photo of Public Service Vehicles lining up for inspection at NTSA Centre, Nairobi. /NTSA

Road service licenses for public service vehicles will increase between 98% to 100%. This means that for a road license for a PSV with between 6-8 passengers, one risks paying Ksh2,700 to Ksh5,400 while that of a PSV with 26 passengers or more will witness a 98% rise to Ksh8,400.

Vehicle inspection charges will also rise between 100% and 250% with vehicles below 3000 cc (cubic centimetres) charged Ksh2,000 for inspection up from Ksh1,000. For heavy commercial vehicles exceeding 5 tonnes, drivers will have to part with Ksh3,500 from Ksh1,000 which is a 250% increase.

The cost of motor vehicle registration has also been proposed to go up by 100%. That is, registration of vehicles below 1000cc will increase from Ksh1,700 to Ksh3,400 while those 3001 and above cc will pay Ksh16,600 up from Ksh8,300.

The proposals will also see you pay 3900% more to change the particulars such as the colour of your vehicle from Ksh500 to Ksh20,000. Furthermore, the transfer of ownership for motor vehicles not exceeding 1000cc will cost you five times more from Ksh1,660 to Ksh10,000. The transfer of ownership of other vehicles will go up by 100%.

The renewal of licenses for motor vehicle dealers is also proposed to go up. For a second-hand motor vehicle dealer license, you will pay Ksh100,000 up from between Ksh4,200 and Ksh9,600 which is an increase of over 2200%.

In an interview with Citizen TV on Monday, December 18, Transport Cabinet Secretary (CS) Kipchumba Murkomen disclosed plans to increase the charges for acquiring number plates up to an excess of Ksh10,000, from the current Ksh3,000.

VAT On Fuel

For those not yet in the know, you are currently paying more than Ksh200 (except for Kerosene) for a litre of either Super Petrol or Diesel for your vehicle courtesy of the Value Added Tax (VAT) on fuel which doubled from 8 percent to 16 percent.

The extra 8 percent VAT on fuel was viewed to have an adverse effect, especially on fuel price per litre, national revenue and cost of essential household products.

The Parliamentary approval saw petroleum products such as petrol, diesel and kerosene be the first affected by the price increase, with the 8 per cent equivalent to approximately Ksh15, which would be added to the cost of petrol, provided that other factors of supply and demand stayed constant.

Regarding the fuel price, owing to the current Energy and Petroleum Regulatory Authority (EPRA) prices for the month of June-July among other factors to be taken into consideration while setting new prices, the cost of Super Petrol was likely to go from Ksh182.4 in Nairobi to Ksh196.992 by July 2023 and subsequently might have shot to more than Ksh200, which was the case in reality during the September-October monthly review.

Diesel, on the other hand, which in June went for Ksh167.28 was to increase by 8 per cent (Ksh13.3824) to around Ksh180.6624 per litre at fuel stations in Nairobi. Kerosene, which retailed at Ksh161.48 at the time was to increase by 8 per cent (Ksh12.9184) more to Ksh174.3984 at fuel stations in the capital.

With the additional eight per cent, the increased fuel prices triggered a ripple effect in terms of the cost of living, with matatu fares among others forced to increase in the days that followed the announcement of monthly fuel prices by EPRA.

The increase in VAT was just one of the many factors to be taken into consideration concerning fuel prices in the country. Other factors considered included the global oil price and the exchange rate, which had a varied effect.

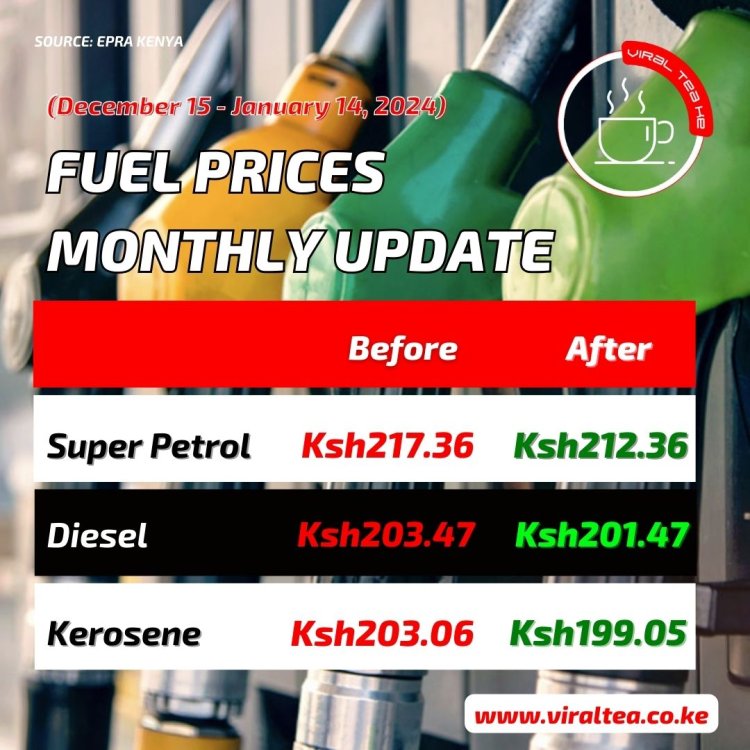

Currently, Super Petrol, Diesel and Kerosene retail at Ksh212.36, Ksh201.47 & Ksh199.05 ahead of the festive period.

admin

admin