CBK Gives 4.2 Million Kenyans Listed On CRB 50 Per Cent Discount

The exercise is slated to expire on May 31, 2023.

The Central Bank of Kenya (CBK) has moved to lessen the burden of 4.2 million Kenyans listed by Credit Reference Bureaus (CRB) for defaulting on loans as part of reforming their credit status.

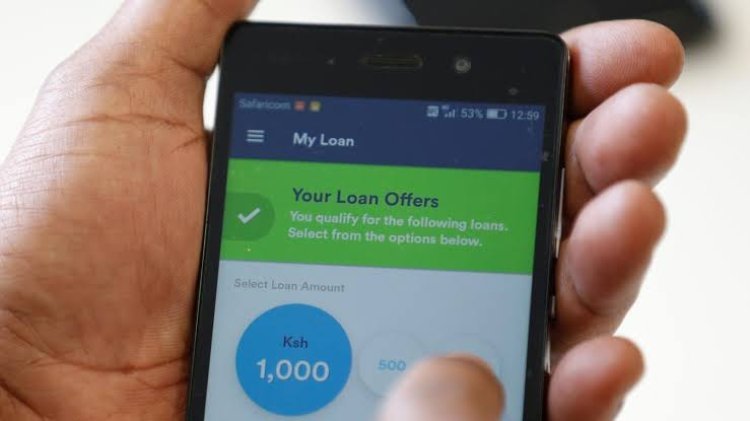

In a notice dated Monday, November 14, CBK announced that it was introducing a Credit Repair Framework by commercial banks, microfinance banks mortgage finance companies (the institutions) to improve the credit standing of mobile phone digital borrowers whose loans are non-performing and have been reported as such to CRB.

"Through the Framework, the institutions will provide a discount of at least 50 per cent of the non-performing mobile phone digital loans outstanding as at end October 2022, and update the borrowers' credit standing from non-performing to performing.

CBK Governor Patrick Njoroge. /FILE

"The institution will then enter into a repayment plan with the borrowers for a period up to May 31, 2023, for the balance of the loan. Upon expiry of the Framework, the credit standing of the borrowers with respect to these loans will depend on their repayment performance during the six-month period," read the statement in part.

The exercise is slated to expire on May 31, 2023.

The notice also indicated that the Framework will also cover loans with a repayment period of 30 days or less and was offered by the institutions through mobile phones.

"It is anticipated that the Framework will enable over 4.2 million mobile phone digital borrowers, adversely listed with CRBS, to repair their credit standing.

"The total value is approximately Ksh30 billion, equivalent to 0.8 per cent of the gross banking sector loan portfolio of Ksh.3.6 trillion at end October 2022," added the statement.

The financial sector regulator maintained that the framework was aimed at covering the personal and micro enterprises sectors that were affected by the Covid-19 pandemic, noting further that the livelihoods were severely impacted by the pandemic through inter-alia loss of employment and closure of their micro-enterprises.

The Framework will thus enable the segment of borrowers to access credit and other financial services as they rebuild their lives and livelihoods.

The announcement comes at a month whereby President William Ruto promised to address the plight of over 4 million Kenyans blacklisted by the CRB system.

Speaking on Wednesday, September 28 at a joint presser between two local banks and a mobile network provider at Norfolk hotel, Ruto revealed that the decision to eject those Kenyans from the negative CRB listing is important because Kenyans have been blocked from borrowing loans to sustain themselves.

He was in support of a plan by credit providers and stakeholders to provide a graduated mechanism instead of the blacklisting mechanism which caused nightmares amongst Kenyans.

"I’m very happy that between 4-5 million Kenyans will, by the beginning of November. be out of the CRB blacklist. This is very important because these Kenyans have been excluded from any formal borrowing and have been left at the mercies of shylocks that exploit them," he said.