28-Year-Old Man Hacks Into CRB, Blacklists Four Ex-Girlfriends

Many times she was turned down because of a negative listing that barred her from taking any loans

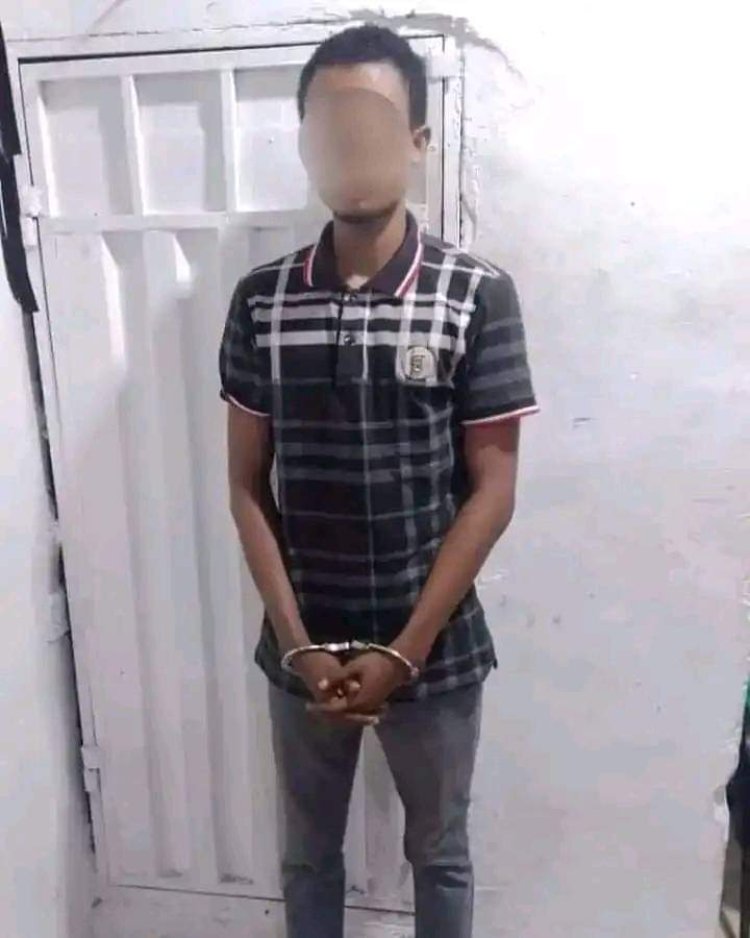

A 28-year-old man was on Wednesday, August 24 arrested after allegedly hacking into a Credit Reference Bureau (CRB) portal and including four women on its infamous 'blacklist'.

Reports indicated that the women he had added to the CRB portal system happened to be four women he previously dated. Photos seen by Viral Tea showed him in handcuffs.

One of the women who spoke on condition of anonymity lamented that she was unable to access funds from various credit financiers because of the man, identified as Nick.

A man arrested after hacking into the CRB portal and blacklisting his ex-lovers on August 24, 2022. /FLAME TV.FACEBOOK

Many times she was turned down because of a negative listing that barred her from taking any loans, thus she blasted him for committing one of the country's most daring manoeuvres.

"It's so unfair what Nick did. I have been applying for loans from financial institutions and used to get turned down because of what he did.

"He is so evil let him rot in jail," she said as quoted by a local blog.

How To Check If You're Listed On CRB

Credit Reference Bureau (CRB) is one of the essential agencies in the country. The firm collects information from registered financial institutions.

In turn, it makes sure that the gathered consumer credit details are available to all the credit lending establishments across the country.

A positive CRB status means that you are consistent in repaying your loans while a negative listing means a defaulted credit.

If you happen to fall in the latter category, you are listed in a blacklist record that is accessible to all lenders. As a result, you barred from seeking another loan due to your bad reputation.

There are three credit reference bureau institutions with authority to check on non-performing loans. They include Transunion, Metropol and Creditinfo.

To check your CRB status on TransUnion:

- You first need to register by sending your full names to 21272. The SMS charge is Ksh19. To save on money, download the TransUnion Nipashe app.

- You then enter your ID number

- Choose Credit Status

- You will receive your CRB status. If you receive good, it means you are not blacklisted while default means blacklisted.

To check your status on Metropol Corporation:

- First pay a registration fee oofKsh50 through the paybill number 220388 then enter your ID number as the account number.

- You will get a SMS with a unique pin, a reference number and a special link

- Dial *433# and put your PIN and you will receive your CRB status. You can also visit the metropol website, Login and view you status.

To check your status on CreditInfo, you will need to fill their request form online.

President Uhuru Kenyatta in September 2021 announced the moratorium on the negative listing of borrowers with loans below Ksh5 million by CRBs for a year, cutting credit information sharing in the banking sector.

The directive took effect in October last year and is scheduled to end on September 30, 2022.

A woman on her phone. /FILE

admin

admin