The Central Bank of Kenya (CBK) on Thursday, September 29 announced that it will increase the minimum lending rate imposed on loans by banks, meaning that Kenyans will pay more to access loans.

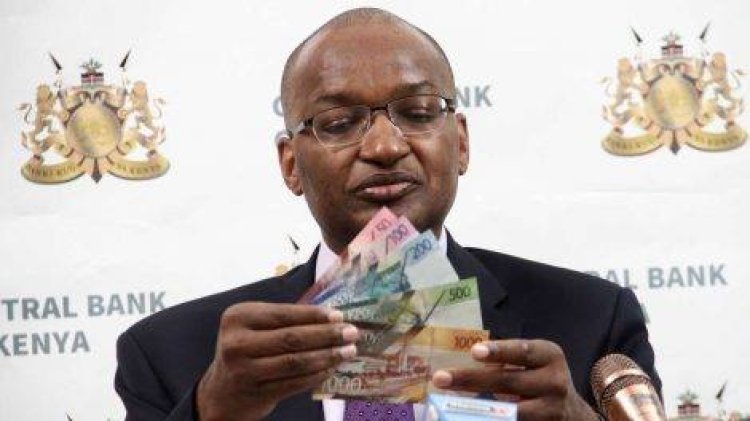

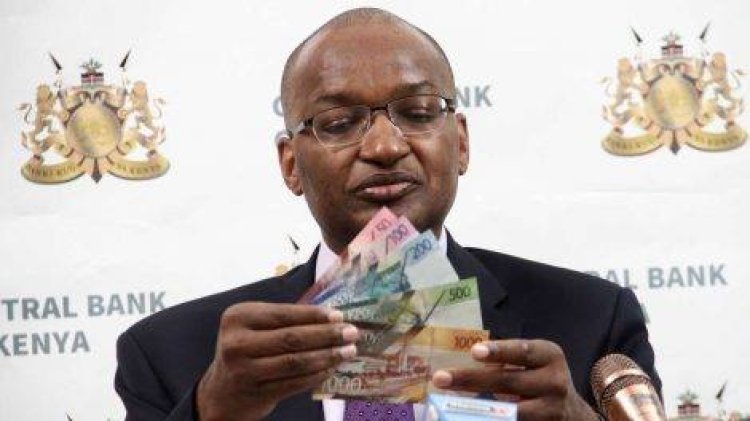

CBK governor, Patrick Njoroge, announced that the Monetary Policy Committee (MPC) had resolved to increase the rate from 7.5 to 8.25 per cent in its efforts to deal with the inflation causing the high cost of living. This is the sharpest increase since 2015.

Njoroge added that the MPC will monitor how the increase of the benchmark lending rates will have an impact on the economic situation in the country and will meet in November to discuss the issue.

CBK governor, Patrick Njoroge, with a bundle of notes. /NAIROBI NEWS

CBK is moving to protect lenders from the detrimental effects of an increase in inflation rates domestically and globally.

"The committee noted the sustained inflationary pressures, the elevated global risks, and their potential impact on the domestic economy and concluded that there was scope for a tightening of the monetary policy in order to further anchor inflation expectations.

"In view of these developments, the MPC decided to raise the Central Bank Rate (CBR) from 7.50 per cent to 8.25 per cent," read the statement in part.

The MPC also named the steps set by the government for the purposes of raising enough funds to meet the budget for the 2022/23 financial year.

"The Committee noted that the ongoing implementation of the FY2022/23 government budget, particularly the strong tax revenue collection, reflects enhanced tax administration efforts and increased economic activity," read the statement in part.

To deal with the inflation rates, the bank regulator relied on the positive economic growth in the country over the last year to protect Kenyans from inflation.

This will be done by tapping into local business investments to counter the effect caused by foreign exchange levels due to an increase in reliance on imported goods such as petrol and palm oil.

Among the sectors that displayed a promising future is the banking centre with CBK reporting an increase in loan repayments and recoveries and the reduction of non-performing loans in the country.

"Strong credit growth was observed in manufacturing (15.2), trade (13.3), business services (16.1), and consumer durables (14.3) per cent. The number of loan applications and approvals remained strong, reflecting improved demand with increased economic activities," Njoroge disclosed.

With the minimal rate increased to 8.25 per cent, banks now have the freedom to charge up to 15.25 per cent interest on loans it offers to Kenyans.

However, they will also choose to offer credits to the government and blue chips to avoid high default rates from the common mwananchi.

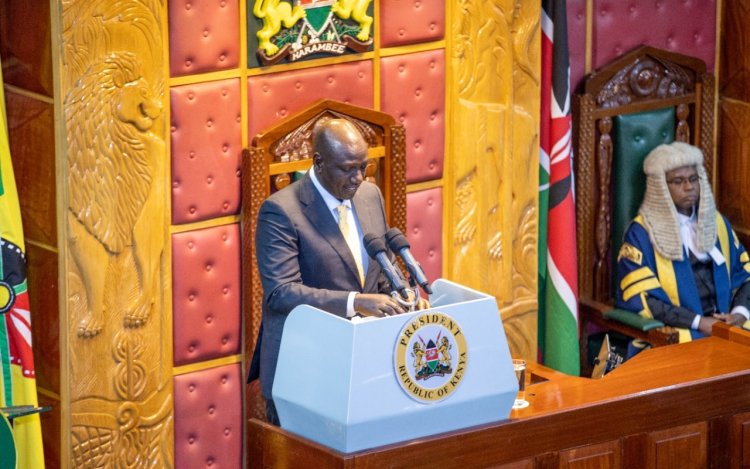

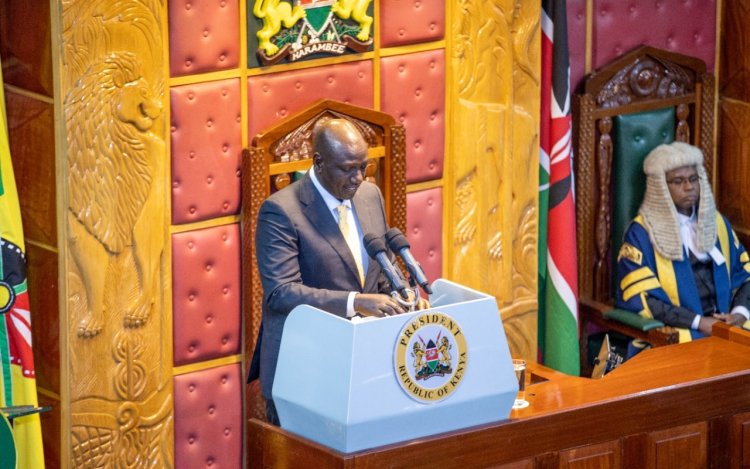

President William Ruto, in his speech while opening the 13th Parliament on the same day, instructed the Treasury to cut down Uhuru's last budget by Ksh300 billion, specifically reducing expenditure on unnecessary items that were budgeted for.

President William Ruto giving his speech in Parliament on September 29, 2022. /WILLIAM RUTO

admin

admin