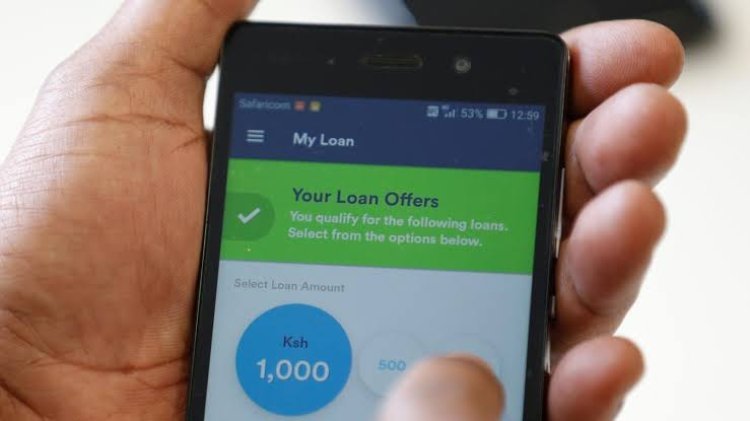

CBK: Here Are 10 Mobile Loan Providers Allowed To Operate In Kenya

The 288 had applied for fresh licences to conduct their operations in the country from March 2022, a process that concluded on September 17, 2022.

The Central Bank of Kenya (CBK) has published a list of 10 approved Digital Credit Providers - DCPs out of 288 in total that had applied for a fresh license to operate in Kenya.

The 288 had applied for fresh licences to conduct their operations in the country from March 2022, a process that concluded on September 17, 2022.

The process, CBK said while beginning the transition period for the DCPs, was to ensure that all operating yet unlicensed DCPs applied for a license within six months of the publication of the CBK, Digital Credit Providers regulations, 2022.

CBK however noted that the process of approval was still ongoing and that other applicants would be incorporated in due course having been at different stages of the process.

"CBK has received 288 applications since March 2022 and has worked closely with the applicants over the last six months in reviewing their applications.

"Additionally, CBK has engaged other regulators and agencies pertinent to the licensing process, including the Office of the Data Protection Commissioner. We acknowledge the efforts of the applicants and the support of other regulators and agencies in this process." CBK stated in part.

Some of the approved DCPs so far include Ceres Tech Limited, Getcash Capital Limited, Giando Africa Limited (Trading as Flash Credit Africa), Jijenge Credit Limited, Kweli Smart Solutions Limited, and Mwanzo Credit Limited.

Others include MyWagepay Limited, Rewot Ciro Limited, Sevi Innovation Limited and Sokohela Limited.

CBK urged the remaining applicants to submit the pending documentation expeditiously to enable the completion of the review of applications.

CBK however urged other unregulated DCPs that did not apply for licensing to cease and desist from conducting digital credit business.

"This is pursuant to Section 59(2) of the Central Bank of Kenya Act (CBK Act), that required all operating unregulated DCPs to apply to CBK for a license within six months of the publication of the Central Bank of Kenya (Digital Credit Providers) Regulations, 2022 (the Regulations), i.e., by September 17, 2022, or cease operations," it added.

"The licensing and oversight of DCPs as indicated previously was precipitated by concerns raised by the public about the predatory practices of the unregulated DCPs, and in particular, their high cost, unethical debt collection practices, and the abuse of personal information."

The move by CBK came following public concerns regarding the illegal operation of DCPs and their flouting of rules set out to control the sector.

The digital lending industry has been regularly accused of its high-interest rates, unethical debt collection practices and the abuse of personal information.

A woman on her phone. /FILE

admin

admin