Factors Influencing Mad Rush By Super Rich To Buy Homes In Kenya

In particular, the sectors where they invested include...

A majority of super-rich individuals across the world are choosing Kenya as a preferred investment country to purchase new homes, more than the likes of the United Kingdom (UK) and the United States (US).

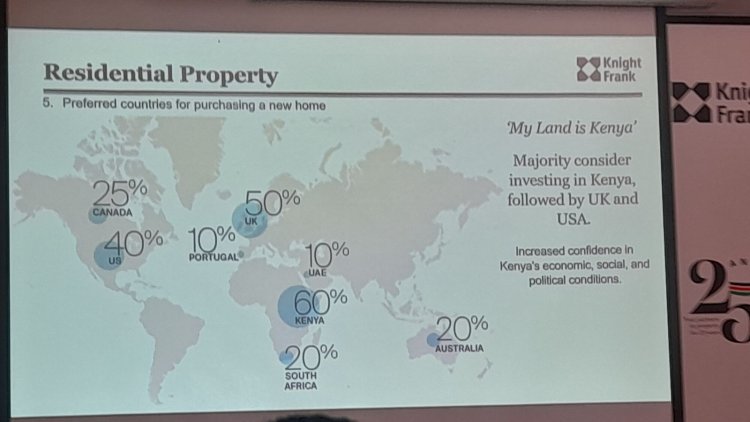

The 2023 Knight Frank Wealth Report on Wednesday, March 1 revealed that 60 per cent of investors are opting to invest in Kenya, with 50 per cent choosing the UK, 40 per cent the United States (US), 25 per cent in Canada and 20 per cent in South Africa and Australia respectively.

In particular, the sectors where they invested include offices (32 per cent), industrial and logistics (32 per cent), retail (68 per cent), residential private rented sector (68 per cent), hotels and leisure (41 per cent), development land (50 per cent) and student housing (23 per cent).

45 per cent of the investors revealed that they leaned towards the agricultural sector, with 36 per cent deciding to pour funds into retirement savings and 27 per cent opting for education.

An infographic showing preferred countries for purchasing a new home. /MARVIN CHEGE.VIRALTEAKE

Speaking to Viral Tea, Tarquin Gross, the head of the residential agency in Knight Frank Kenya, attributed the huge interest in Kenya to a rebounding residential market following a five-year silence where there has been huge growth prior to the COVID-19 pandemic and the 2022 general elections.

"What we're seeing in 2022 is definitely a rebound in the residential market, we had a quiet period over the last five years. We saw huge growth for a long period and then it's been quite stable because our growth was too high, too quickly and so things stabilised. Then we had COVID and then we had the elections and things had been quite stagnant in terms of transactions and everything.

"What we noticed in 2022 is that as we sort of came through the other side of COVID and furthermore we had a very quiet election, people's decision to buy...people were much more interested in buying second homes or looking at buying bigger primary residences or having the confidence that the market was there and that the wealth was secure or it wasn't as risky," stated Tarquin.

With regards to specific areas of interest, Tarquin highlighted the coastal region in Kenya which has suddenly seen an upturn in fortunes, particularly in popular tourist destinations such as Kilifi, Diani and Lamu as well as Mombasa recording a huge number of transactions in 2022, turning the region into a best-performer.

He however did not rule out the cities of Nairobi and Kisumu in terms of those seeking new homes, particularly the capital which is known to host a number of international organizations and businesses.

"Further afield, Kisumu we saw a lot of activity as well, some more of those Western territories, it's not an area that we (at Knight Frank) have a huge amount of transactions in but we have a lot of inquiries about and so a lot of interest in it, and then also Nairobi. It was a very good performing city last year with the number of transactions and also second-home transactions which are something we haven't seen over the last few years," he added.

When further posed to clarify the spiking interest in Nanyuki town in Laikipia County, Tarquin noted that even though Knight Frank deals with high-end residential properties in Kenya, Nanyuki is a town that has turned into huge potential, especially with the development projects taking place and the affordable land prices.

"Where Knight Frank sits...we're prime residential, we target sort of the high-end residential properties across the country so that's where places like our coastal towns did very well. Nanyuki again has extremely good numbers as well.

"We're seeing a drive...what COVID led to was people could work from home but also could see themselves living outside of Nairobi so Nanyuki...with the new roads going in, it's going to be a three-hour drive from Nairobi to Nanyuki, at one stage it was five hours. The connection between Nairobi and Nanyuki is there and I think we're seeing a huge amount of interest in people moving to Nanyuki because it's slightly more affordable; land you can get more space for your money and it's a beautiful place to live," he went on.

He further recognised the good infrastructure put in place as well as the road network to and from the town, shopping malls such as The Cedar Mall, a good hospital as well as safety, motivated by the presence of the British Army Training Unit (BATUK) training camp in the town.

Tarquin also recognised the efforts of President William Ruto's government in encouraging business and investments into the country, which is also driving property prices, especially in the prime markets with international investors.

"When we talk about the Coast, the majority of that investment was international money, when we talk about Nanyuki, it might be international bars but there are residents of Kenya, ex-pats living in Kenya but looking to buy a home, maybe they rent in Nairobi and work for some of the bigger multinational organisations who fall in love with the country.

"I think also the government is making ways easier for internationals to buy into Kenya, not so much in the sense that it's stopping Kenyans...but definitely making it more transparent on how people can buy property in Kenya but also makes people feel safer. If you're an international and you don't know a huge amount about Kenya, it's quite transparent; you would need a lawyer but it's quite transparent on how to buy into Kenya and that also encourages," he added.

According to him, the more people buy into Kenya from a residential point of view, the more this brings other wealth to other organisations within Kenya.

The report further noted that residential properties were considered the safest and least volatile asset in terms of investments. Cryptocurrencies, equity markets, and commercial properties were considered the most volatile respectively.

Of those considering investing in commercial property, 13 per cent opined that they would spend up to Ksh63 million, and 16 per cent revealed that they would invest up to Ksh127 million. 11 per cent affirmed that they would invest over Ksh2.5 billion in the commercial sector.

A beach in Diani, Kenya. /BRILLIANT AFRICA

admin

admin