Govt To Watch How Much You Send, Receive Via Mobile Money

The government is targeting to collect up to Ksh4 trillion by 2024 and Ksh3 trillion by the financial year 2023/24.

The Kenya Revenue Authority (KRA) could soon start monitoring Kenyans' mobile money transactions amidst a plan to integrate tax systems within the domains of telecommunication companies to enhance revenue collection.

This is according to the National Treasury which on Wednesday, January 18, released a draft 2023 Budget Policy Statement in efforts to expand tax collection bases in Kenya through government agencies following a directive by President William Ruto.

The government is targeting to collect up to Ksh4 trillion by 2024 and Ksh3 trillion by the financial year 2023/24.

A person using a smartphone. /FILE

"As part of the economic turnaround plan, the government will scale up revenue collection efforts to Ksh 3.0 trillion in the FY 2023/24 and Ksh 4.0 trillion over the medium term.

"Close monitoring of payments from the government to ensure correct taxes are declared and paid will be done accordingly," the draft 2023 Budget Policy Statement read.

In order to attain this target, the government agencies responsible for the collection and enforcement of tax policies will seek to tap additional revenue from the multi-billion telecommunications industry.

Telcos in Kenya make billions of shillings by providing various services to customers such as voice calls, text messaging, internet access as well as mobile money services to Kenyans on a daily basis.

"The Government will undertake to roll out electronic Tax Invoice Management System (eTIMS), reduction of Corporate Income Tax (CIT) gap from 32.2 per cent to 30.0 per cent of the potential as envisaged in the KRA Corporate Plan and integration of tax system with the Telecommunication companies (Telcos)," the draft 2023 Budget Policy Statement read.

In the 2023 draft statement, the Treasury seeks to recover taxes lost in counterfeit businesses through measures that may also involve members of the National Police Service (NPS), the National Intelligence Service (NIS) and other agencies utilising information to enforce their mandate.

"The prevalence of counterfeit excisable products and stamps in the market will be addressed through the formation of a multi-agency team to investigate the source of counterfeits and take necessary action.

"Data and intelligence-driven field operations to take down counterfeiters; robust and effective market surveillance; regular reviews and upgrades of the security features of stamps and rolling out new excise stamps should it be deemed necessary," the draft 2023 Budget Policy statement read.

President Ruto in October 2022 expressed concern about how there are only 7 million people bearing KRA PINs while at the same time, over 30 million Kenyans transact billions of shillings.

“The fact that this opportunity remains unclear to KRA demonstrates why radicle changes are necessary,” President Ruto said at the time.

One of the other revenue collection measures is the reduction of the VAT gap, which currently stands at 38.9 per cent. KRA plans to roll out the eTIMS system to cut this gap to 19.8 per cent.

This system will help to automate the tax invoice process and improve compliance, ultimately increasing revenue collection.

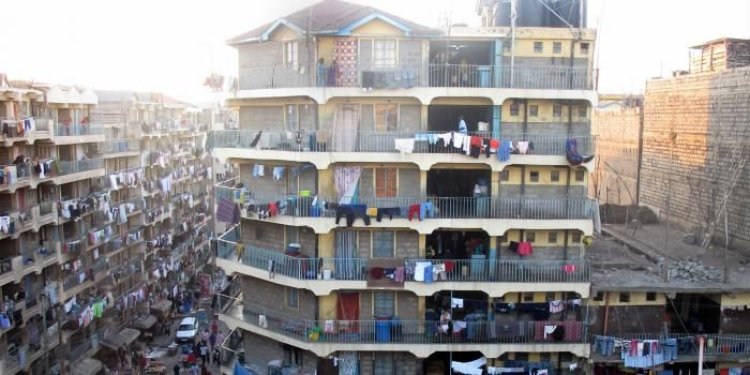

KRA also plans to implement rental income tax measures by mapping rental properties and using a mobile App to track and monitor rental payments.