KRA Extends Deadline To File Tax Returns

The deadline, originally set to lapse at midnight on Monday, June 30, has been pushed to midnight on Tuesday, July 1.

Kenyans rushing and scrambling to file their annual tax returns will be pleased to learn that the Kenya Revenue Authority (KRA) extended the deadline by one day.

The deadline, originally set to lapse at midnight on Monday, June 30, has been pushed to midnight on Tuesday, July 1.

KRA said the extension aims to give Kenyans more time to file their tax returns after the iTax system experienced technical glitches on the final day of filing, that is, June 30.

Support services at the contact centre will also remain available between 7 am and 8 pm on Tuesday for those needing assistance.

Workers inside the Kenya Revenue Authority offices. /KRA

"Tumefungua (we have opened the) service lane! 24-hour extension up to tomorrow, 1st July 2025, midnight to file and pay your returns!" announced KRA.

In addition, tax offices at service centres nationwide will stay open longer — from 8 am to 8 pm — to help taxpayers with last-minute filings and provide necessary support.

The Kenya Revenue Authority (KRA) states that submitting annual tax returns is a mandatory legal duty for all qualifying taxpayers, not only those in formal employment. This obligation extends to business owners, landlords, farmers, and even individuals with no income during the year, who must file a NIL return.

KRA stresses that tax returns must be filed regardless of whether an employer already deducts and remits Pay As You Earn (PAYE) on an employee’s behalf. For those who are self-employed, earn rental income, or engage in farming, it is legally required to declare all income sources.

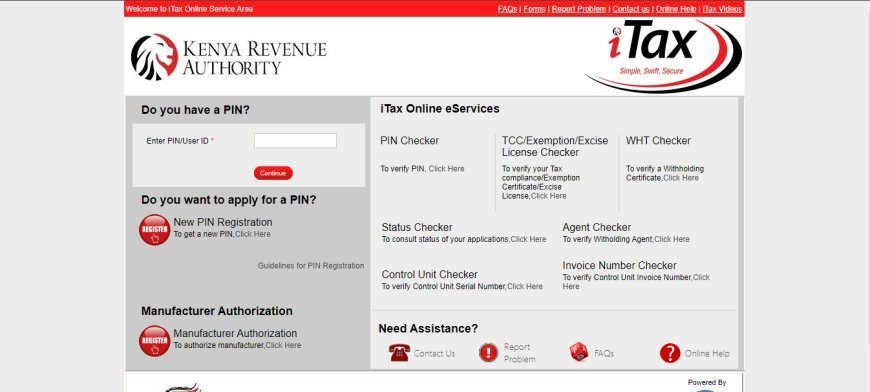

KRA is encouraging Kenyans to file their tax returns via the iTax portal at itax.kra.go.ke. Failure to submit returns by the stipulated deadline results in penalties. KRA enforces a fine equivalent to five per cent of the tax due or Ksh2,000 — whichever amount is higher — for late filing.

Additionally, if there is any outstanding tax after the deadline, a further penalty of five per cent of the unpaid tax will be applied, along with a monthly interest of one per cent until the liability is fully cleared.