KRA Announces New Way For Kenyans To Log In To iTax

Until now, access to the iTax system was strictly PIN-based—a process many found cumbersome, especially during the busy tax filing season.

The Kenya Revenue Authority (KRA) has rolled out a new login feature on its iTax platform, enabling taxpayers to access services using their National ID numbers.

This update follows widespread public outcry over challenges experienced while trying to access the system, particularly during tax return deadlines.

KRA noted that many users complained about forgetting or losing their Personal Identification Numbers (PINs), which were previously the only means of logging in.

Until now, access to the iTax system was strictly PIN-based—a process many found cumbersome, especially during the busy tax filing season.

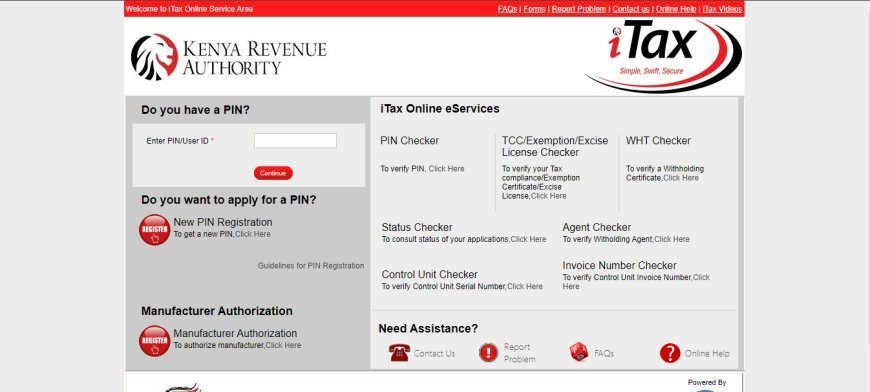

Screengrab of KRA's iTax website. /VIRAL TEA KE

“In a major step toward improving service delivery and encouraging tax compliance, the Kenya Revenue Authority (KRA) has introduced the use of National Identity Card (ID) numbers as a new login option for individual users on the iTax platform,” the Authority said in a media brief.

However, the authority has clarified that the PIN login option will remain available. The newly introduced ID-based login is expected to offer a more convenient alternative for many taxpayers, especially during the peak return filing period.

“The decision to implement this option was driven by feedback from taxpayers who noted that ID numbers are easier to remember and more frequently used in everyday identification processes.

“By offering an option that aligns with users’ preferences and habits, KRA hopes to reduce friction in accessing services and promote greater uptake of digital tax services,” the statement added.

Although the login process has been updated, all core iTax services will continue to be accessible. These include filing tax returns, making payments, applying for Tax Compliance Certificates, and receiving official communication from the Kenya Revenue Authority (KRA).

The introduction of the ID-based login is part of ongoing reforms aimed at modernizing tax administration and creating a more taxpayer-friendly system.

KRA is working to streamline its digital infrastructure, simplify procedures, and enhance accessibility through the use of technology.

To access iTax using the new login option, individual taxpayers must have a valid Kenyan ID and a mobile number that is already registered and linked to their iTax profile. The system will authenticate the ID information before granting access.

The recent update follows closely on the heels of KRA’s announcement about two new systems designed to enhance the handling of customs-related disputes in Kenya.

On July 31, the authority unveiled the Independent Review of Objections (IRO) and the Technical Review Unit (TRU), both set to be implemented from August 2025. These systems aim to promote fairness and transparency in resolving disagreements over customs decisions.