Omtatah Explains Withdrawing Case Against Uhuru & Ruto

The case, which has dragged on in court for nearly 10 years, had the two heads of the Jubilee government listed as the first and second respondents.

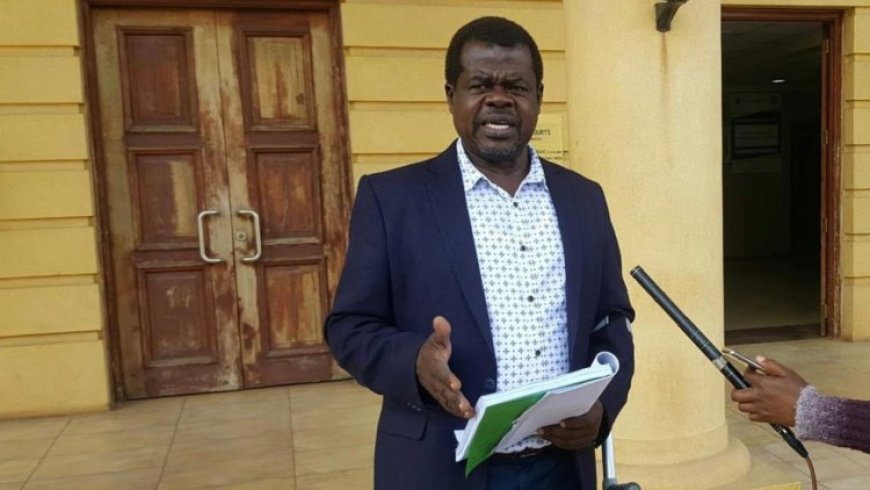

Busia Senator Okiya Omtatah announced on Thursday, April 24, that he was withdrawing Petition 531 of 2015 filed against former President Uhuru Kenyatta and his successor, William Ruto, which focused on Kenya’s controversial public debt.

The case, which has dragged on in court for nearly 10 years, had the two heads of the Jubilee government listed as the first and second respondents.

Speaking at a press briefing, the outspoken activist said the move was due to the endless delays caused by legal technicalities—but made it clear that the fight against unjust debt isn't over yet.

“After consultations and given the technical objections raised by the court, it has become untenable to proceed with this petition in the manner that it was. So we have withdrawn it tactically to avoid the cascading disaster that was before us,” Omtatah announced.

Adding “However, we are going to refile the same immediately so that we can avoid all those technicalities that were being placed in our way like minefields."

Back in 2015, Omtatah and Nyakina Wycliffe filed a petition against Uhuru Kenyatta and William Ruto over the Eurobond saga, accusing the duo of breaking several Kenyan laws, alleging that part of the Eurobond funds had been misused.

"It is their case that the above-mentioned money was raised for the 2014/15 fiscal year and that USD2 billion of that amount was borrowed for infrastructure development and to repay a syndicated loan owed by the Government in December 2014. They further allege that the remaining USD750 million was borrowed in December 2014 from the International Market through the Eurobond by means of “Tap Sales” to finance infrastructure projects.

"They aver further that the funds were illegally and unlawfully deposited in an offshore account instead of being deposited into the Consolidated Fund as required by the Constitution and the Public Finance Act of 2012, and further, that the offshore account was never surrendered to the Controller of Budget to approve it," the petition read in part.

This comes days after Omtatah claimed the country has no public debt. Speaking during a Bunge la Wananchi forum on Saturday, April 19, Omtatah challenged any official claiming that the country is struggling with crippling debt to support the claims with evidence.

“I want to say here today, Kenya, we do not have any debt. We have paid all the dues, but they keep saying we are in debt,” Omtata told a crowd, adding, “We want to know about this money which they keep saying we owe. The individuals involved [need] to tell us the business they were indulging in with this debt.”

Omtatah argued that the massive loans borrowed under former President Uhuru Kenyatta and current President William Ruto fall squarely on their shoulders. He pointed to a 2014 unconstitutional tweak to the Public Finance Management (PFM) Act as the moment things started spiralling, saying it triggered a financial mess for the country.

According to the Senator, the amendment, done without Senate approval in violation of Article 110 of the Constitution, handed Treasury officials unchecked power to open foreign accounts and cut loan deals without any public or parliamentary oversight.

Omtatah’s claims, however, don’t line up with the official data on Kenya’s public debt, which currently sits at around Ksh11 trillion. Of that, Ksh5 trillion is domestic debt, mostly made up of treasury bills and bonds, while Ksh5.09 trillion is external debt owed to multilateral, bilateral, and commercial lenders.

The government, through Treasury CS John Mbadi, has consistently maintained that Kenya is on track to clear its debt within the next decade.

As it stands, the country’s debt is at 63 percent of GDP, still under the 70 percent ceiling, even though it is above the 55 percent ideal threshold. Kenya has until November 1, 2029, to get its debt ratio fully in line with the set regulations.

President William Ruto and Uhuru Kenyatta on December 9, 2024. /UHURU KENYATTA