Student Housing & 11 Areas Rich Kenyans Are Investing In- Report

Student housing was among the top five in terms of investor interest in property investments other than homes.

Wealthy Kenyans are shifting their attention more often towards student housing in the country in a bid to meet the growing demand for residences friendly to students and providing easy access to their respective universities.

In the Kenyan edition of the 2024 Wealth report released by real estate firm Knight Frank, student housing was among the top five in terms of investor interest in property investments other than homes.

Farmland emerged as the most popular at 77.5 per cent followed by hotels and leisure at 69.4 per cent. Private rented residential followed at 58.6 per cent with student housing rounding the top four at 52.7 per cent.

Retail, which includes supermarkets, scored 50 per cent followed by healthcare at 49.7 per cent, education at 30.3 per cent, development land at 30 per cent and offices at 20.8 per cent. Data centres, logistics and real estate debt tied at 13.3 per cent.

A farmland for sale in Narok County, Kenya. /KNIGHT FRANK

Such investments also coincide with a rise in attention to reducing carbon, with 60 per cent of HNWIs now investing in renewable power sources, and around half investing in increased nature and biodiversity and seeking sustainable certification and energy efficiency ratings.

That's not all. Kenyan tycoons who reap big from the aforementioned property investments which are assets in themselves have areas where they splash their money on.

Why Are Kenyan HNWIs Preferring Art Over Cars?

In 2024, the High Net-Worth Individuals (HNWI) developed a liking for art to grow their assets. Last year, this was not the case.

The report titled A Perspective on Kenya Wealth Investment Trends revealed that 71.3 per cent of tycoons made investments in the art sector. This was an over 10 per cent increase from the figures recorded in the 2023 report.

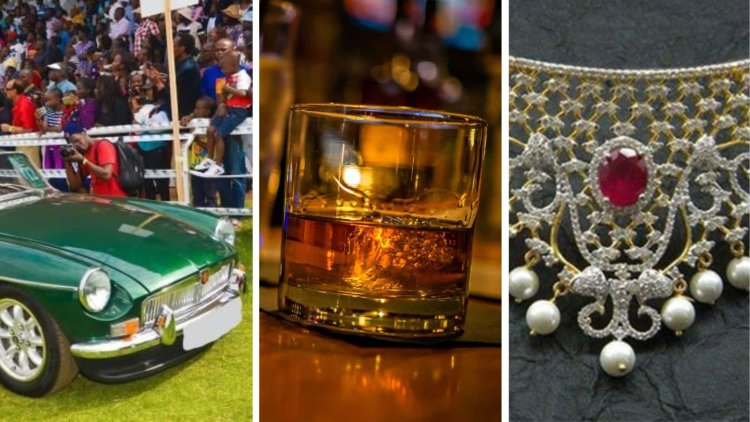

Other investment areas were cars (57.14 per cent), watches (57.14 per cent), whiskey (42.86 per cent), jewellery(42.86 per cent) and furniture (35.71 per cent).

Additionally, tycoons were opting to splash their money on bags (28.57 per cent), wine (28.57 per cent), diamonds (14.29 per cent) and coins (7.14 per cent).

"A noteworthy shift in the investment preferences of Kenyan HNWIs has been observed, signalling changing trends in investments of passion. A substantial 70% of our Kenyan HNWI clients expressed a keen interest in art, a significant uptick compared to the previous year when the majority (50%) showed a penchant for purchasing classic cars.

"This shift aligns with global patterns, as evidenced by The Knight Frank Luxury Investment Index (KFLII), which tracks the performance of 10 popular investments of passion. The latest data from the KFLII underscores the rising prominence of art as the best-performing luxury asset class 2023, experiencing an impressive 11 per cent price increase," read the report in part.

This sudden change of interest in art was not isolated to Kenyan tycoons with investors making efforts globally to make art part and parcel of their investment portfolio.

"The shift from classic cars to art among Kenyan clients suggests a dynamic response to global investment trends and attests to the evolving nature of passion investments," Knight Frank reported.

"The resilience of the art market in the face of broader economic fluctuations further underscores its appeal as a tangible and culturally rich asset class."