What Happens If You Default On Hustler Fund Loan

The products of the Fund include Personal Finance, Micro Loan, SMEs Loan and Start-Ups Loan. The Personal Finance loan will be the first to be launched.

President William Ruto will on Wednesday, November 30 launch the highly-anticipated Ksh50 billion Hustler Fund credit access kitty at the Green Park Terminus in Nairobi.

It has been one of the key promises by the Head of State in his campaigns leading up to the August 9 general elections whereby he seeks to use the fund to commit billions of shillings to support sectors such as boda boda and small retailers.

The fund, which is split into four categories, also seeks to supplement President Ruto's promise to bring about a new economic order that would deal squarely with unemployment and lack of opportunities for the youth.

The products of the Fund include Personal Finance, Micro Loan, SMEs Loan and Start-Ups Loan. The Personal Finance loan will be the first to be launched.

The fund has a 14-day repayment period and an annual interest rate of 0.002 per cent calculated per day. That is, a customer who borrows Ksh500 will pay back Ksh501.53 after 14 days, representing Ksh1.53 in interest.

In comparison, the popular Fuliza overdraft service has loans of between Ksh101 to Ksh500 now having a daily fee of Ksh2.50.

Fuliza loans of between Ksh501 and Ksh1,000 have a daily fee of Ksh6 while those between Ksh1,501 to Ksh2,500 have a daily rate of Ksh20. Fuliza has a repayment period of one month (within 30 days).

And If You Don't Pay The Hustler Fund Loan In Time?

If the Hustler Fund loan is not paid back within 14 days, the customer’s credit rating is affected, and they are given an additional 15 days. If the loan is still not paid back, the interest rate increases to 9.5 per cent per year.

The Hustler Fund account is frozen and the borrower loses all accumulated credit scores after more than 30 days of default.

There is also no listing on the Credit Reference Bureau (CRB), so this default has no impact on the debtor’s credit score with other lenders. The borrower who defaults may pay off the loan all at once or in instalments, and after full repayment, they may borrow again.

When a customer borrows, the approved loan is sent to their mobile money account, deposits 95 per cent of it in their money wallet, and places 5 per cent of it in their savings account. The five per cent that goes toward the savings plan is then split into 30 per cent for short-term savings and 70 per cent for long-term (pension) savings.

How To Apply

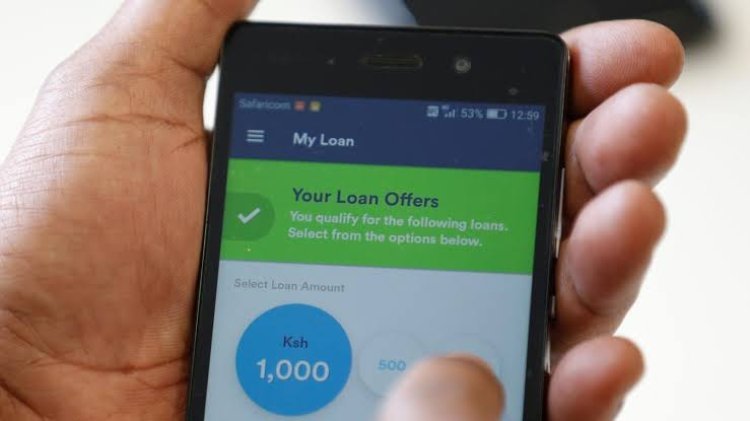

Kenyans can access the Hustler Fund through a USSD code (*254#) and mobile app platforms offered by all the country's mobile network providers.

How to Apply for Hustler Fund Loan via USSD

- Applicants will be required to dial the USSD code *254#

- Select the loan request option to view the limit, interest, and loan tenure.

- Enter the loan amount and press OK to continue

- Confirm loan details

- Enter Mobile Money pin

- Receive SMS notifications on Loan allocation

How to Apply for Hustler Fund Loan via Mobile App

- Enter mobile app from any mobile network operator

- Select the loan request option to view the limit, interest, and loan tenure.

- Enter the loan amount and press OK to continue

- Confirm loan details

- Enter Mobile Money pin

- Receive SMS notifications on Loan allocation

In case someone borrows the loan erroneously, the loan cannot be reversed and must be repaid. The loan is repaid through one’s mobile money account.

Additionally, a customer cannot borrow money using more than one mobile number because the ID number serves as The Hustler Fund’s unique identifier. You must therefore opt out of the registered number if you need to register another one for the Hustler Fund.

Additionally, savings are secure even if a mobile device is lost because the Hustler Fund account is PIN-protected. Once the SIM card is replaced, access to the account will be restored.

admin

admin