2.4 Million Kenyans File Tax Returns Ahead Of Deadline- KRA

This figure represents a robust 15 percent increase compared to the same period in May 2023, underscoring a growing culture of tax compliance and responsibility among Kenyan citizens.

The Kenya Revenue Authority (KRA) on Thursday, June 6 announced that over 2.4 million Kenyans have already filed their 2023 annual tax returns, well ahead of the looming June 30, 2024 deadline.

This figure represents a robust 15 percent increase compared to the same period in May 2023, underscoring a growing culture of tax compliance and responsibility among Kenyan citizens.

In a statement, KRA revealed that an impressive rise in filings is attributed to the effectiveness of the iTax platform, which has revolutionized the tax filing process.

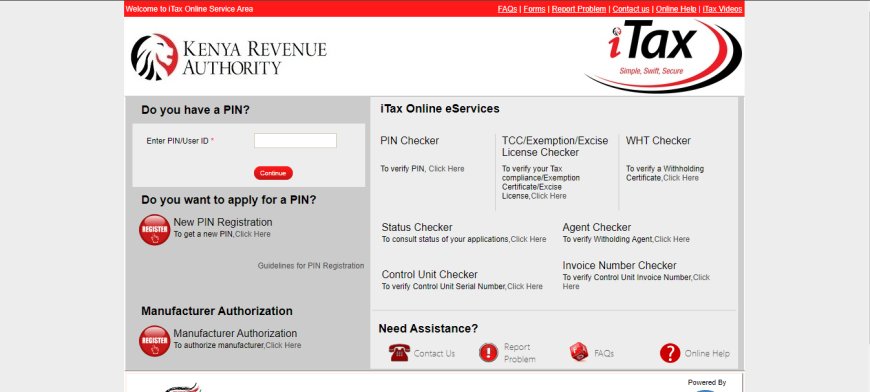

Screengrab of KRA's iTax website. /VIRAL TEA KE

This user-friendly online system has drastically reduced the time and effort required for filing, minimizing long queues and enhancing the overall efficiency at KRA Service Centres across the country.

The ease of access and convenience provided by iTax have evidently encouraged more taxpayers to meet their obligations in a timely manner.

"Notably, the iTax platform has played a pivotal role in streamlining the filing process, with taxpayers experiencing improved efficiency and reduced queuing at KRA Service Centres.

"KRA acknowledges and appreciates all taxpayers who have filed their 2023 annual tax returns. KRA further urges all taxpayers to continue filing their tax returns early to avoid the last-minute rush that comes with deadlines," the authority stated in part.

Tax Amnesty Program Provides Major Relief to Over 640,000 Taxpayers

In parallel with the filing success, KRA's Tax Amnesty Programme has shown remarkable progress, benefiting over 640,069 taxpayers as of May 6, 2024, an initiative deemed a lifeline for many, offering a waiver on penalties and interest, which has provided a cumulative relief of Ksh247.461 billion.

This amnesty has not only relieved financial pressure on individuals and businesses but also fostered a spirit of voluntary compliance and transparency within the tax community.

Under this program, taxpayers have settled overdue principal taxes totalling Ksh22.69 billion, with an additional Ksh29 billion declared as unpaid taxes yet to be resolved.

"KRA encourages all taxpayers to take advantage of the amnesty by settling any outstanding principal tax debts by 30th June 2024," added the authority.

The above deadline represents a crucial opportunity to resolve outstanding issues and avoid further penalties or interest charges.

Commitment to Continuous Support

As KRA continues to enhance its support and facilitation efforts, the authority remains dedicated to aiding all taxpayers in meeting their tax obligations with ease and efficiency.

The combined achievements in tax return filings and the success of the amnesty program reflect KRA’s ongoing commitment to fostering a compliant and well-supported taxpayer community in Kenya.

KRA offices along Mombasa Road, Nairobi. /PEOPLE DAILY