We Will Not Let You Make Kenyans Suffer In 2025- Raila To Ruto Over Finance Bill 2024

Odinga in a statement warned that the people and the country will be way worse off at this time in 2025 if the Finance Bill 2024 does not undergo what he terms as a radical surgery.

Azimio la Umoja One Kenya Coalition Leader, Raila Odinga on Friday, June 7 gave a brutally honest assessment of the Finance Bill 2024 which is proposing more taxes, compounding a tax burden in Kenya that has been at its highest level since independence and public services hanging on by a thread.

Odinga in a statement warned that the people and the country will be way worse off at this time in 2025 if the Finance Bill 2024 does not undergo what he terms as a radical surgery.

The former Prime Minister, who President William Ruto’s government backs for the African Union Commission chairperson seat, criticised the Finance Bill for failing the taxation dictums of predictability, simplicity, transparency, equity, administrative ease and fairness.

"It is worse than the one of 2023, an investment killer and a huge millstone around the necks of millions of poor Kenyans who must have hoped that the tears they shed over taxes last year would see the government lessen the tax burden in 2024.

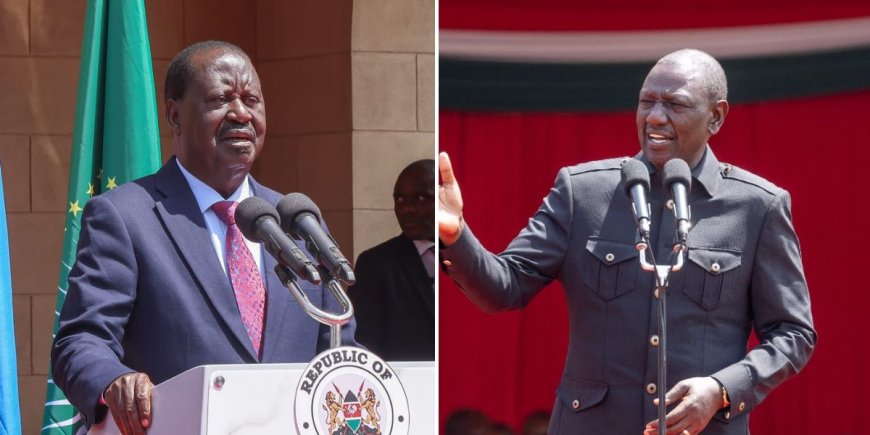

Raila Odinga speaking during the presentation of Limuru 3 resolutions at Chungwa House on June 6, 2024. /RAILA ODINGA

"The Bill is a regressive taxation proposal that goes ruthlessly after the poor. Should it be ratified, low-income people will be hit with taxes on multiple fronts and will end up paying more than people with higher incomes. It is obvious that taxes on basic necessities such as food, cooking oil and money transfers disproportionately hurt the poorest of the poor," he stated in part.

He cried foul regarding another instance of, for instance, the cost of mobile money transfer which is set to rise from last year's 15 per cent to 20 per cent, happening at a time the government is also proposing to slap a 16 per cent VAT on foreign exchange transactions, a matter he claimed would make it more costly for people to send and receive money by phone and at the same time trying to kill remittances from the diaspora.

Odinga was particularly vexed about the proposal to tax bread, a basic commodity that is almost always the only item for breakfast for the poor, at 16 per cent from the current zero-rated status.

"When the government imposes a 25 per cent Excise Duty on edible oil as is being proposed in the Finance Bill 2024, the cost of cooked food, including those served in kibandas and kiosks that are the refuge of millions of casual workers will rise.

"The long-struggling sugarcane sector and its farmers is also being targeted with a 16 per cent tax on cane transportation to factories. Farmers will obviously get less and the cost of sugar will rise. Most of the tax proposals in the Finance Bill 2024 are as insensitive as they are callous," he went on.

The Orange Democratic Movement (ODM) leader believed there would be no positives that Kenya would benefit from the proposal to raise Import Declaration Fees from 2 per cent to 3 per cent, the impact being that the cost of goods will go up, diminishing Kenya's status as a net importer of almost everything.

"Last year, women were targeted with weird taxes on beauty products. This year, they have come up with an even more ludicrous tax called Eco Levy that proposes to levy taxation on a basic product like diapers. Again, it is a fact that the poor often have the most children in our country. Tax on diapers hits them in a place where they have little alternative," he added.

With reference to insurance and reinsurance services, Odinga read malice in a proposal in the Bill to remove the two services from tax exemption and be subjected to 16 percent tax, affecting every kind of insurance, from life to property to health to education.

He warned that this proposal could kill the already struggling insurance industry, with insurance penetration in Kenya at 2.3 percent, lower than Africa's average of 3.2 per cent and a global average of 7 per cent.

Condemning the Motor Vehicle Tax, which he termed the most punitive of them all and beating logic, Odinga shared how a motor vehicle is one of the most taxed items in the country today.

"At least 40 per cent of the price of cars in Kenya are taxes. Vehicle owners are taxed for the number plate, fuel levy, tyres etc. The proposed 2.5 per cent tax on motor vehicles is therefore a perfect case of double taxation. It is a perfect example of unfair and regressive taxation," he stated.

Reflecting on last year's tax measures, Odinga noted "It must be remembered that the tax measures put in place last year and which led to violent protests have subjected Kenyans to a great deal of trauma but bore no fruit. The intended purpose of the 2023 tax measures was to help the government raise more revenue. Instead, the Kenya Revenue Authority consistently failed to meet targets. The high taxes on petroleum products occasioned a fall in the fuel levy raised. They led to the closure and relocation of businesses.

"The tax proposals for 2024 will make an already bad situation worse. They could usher the collapse of an economy that is already severely suffocated, and the poor will be the hardest hit," he added.

Odinga believed that for businesses to invest in Kenya, there cannot be a scenario of a tax policy shooting up and down and changing stances, neither can there be taxation measures designed to eventually inflict more pain on Kenyans looking for a solution.

He thus called on Parliament to "inject very radical surgery on the outrageous proposals in the Finance Bill 2024" asserting that "We will not accept the mistakes and pains inflicted on Kenyans by the Finance Act 2023 to be continued into 2025 through Finance Bill 2024."

Last year, the opposition, which Odinga leads, was outvoted in the passing of the Finance Bill 2023, with 176 MPs voting in favour of the Bill while 81 voted against it. There were no abstentions.