Cabinet Approves Extension Of G2G Oil Deal

The decision came following a Cabinet resolution following a meeting held at State House Nairobi chaired by President William Ruto.

The government on Tuesday, December 17 approved the extension of the government-to-government deal it signed with Saudi Arabia oil companies.

The decision came following a Cabinet resolution following a meeting held at State House Nairobi chaired by President William Ruto.

"The Cabinet has approved the extension of the Government-to-Government (G-to-G) arrangement for the import of refined petroleum products," a Cabinet memo read in part.

According to the Cabinet, extending the deal was necessary as it has helped ease pressure on the Kenyan shilling. The Cabinet also explained that the G to G deal has helped stabilise fuel prices in Kenya.

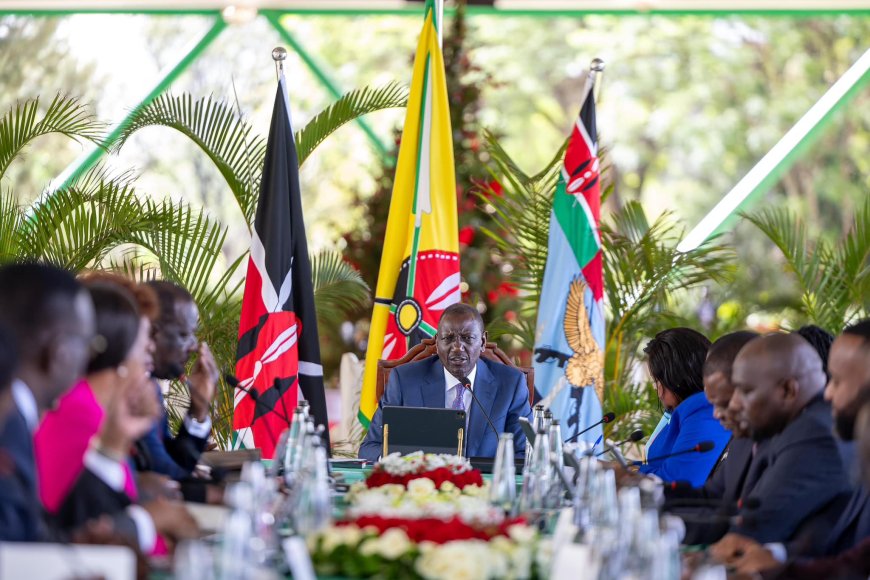

President William Ruto and other Cabinet members during a Cabinet meeting at State House Nairobi on Tuesday, December 17, 2024. /PCS

"This arrangement has eased the monthly demand for US dollars for petroleum imports, stabilising the shilling-dollar exchange rate at KSh129 from a high of KSh166 and reducing pump prices from KSh217 per litre of petrol to KSh177," added the memo.

The extension of the arrangement means that Kenya will continue to access the supply of refined petroleum by allowing payments in Kenya Shillings, previously estimated at $500 million (Ksh65 billion) a month. However, the Cabinet did not give a clear timeline for when the deal extension will expire.

The decision to extend the deal means that Saudi Aramco, Abu Dhabi National Oil Corporation (ADNOC), and Emirates National Oil Company (ENOC) will continue importing petroleum products into the country on behalf of the government.

However, this could bring the government on a collision course with the International Monetary Fund (IMF) after Kenya notified the international lender on November 6, this year of its intentions to exit the deal.

"The government intends to exit the oil import arrangement, as we are cognizant of the distortions it has created in the FX market, the accompanying increase in rollover risk of the private sector financing facilities supporting it and remain committed to private market solutions in the energy market," the IMF report read in part in January this year.

The government further confessed that the deal was a short-term measure to help ease foreign exchange pressures. An extension was secured which runs to December 2024, but according to the Treasury, the market had not eased at the time.

The Cabinet meeting also approved the procurement of Liquefied Petroleum Gas (LPG), Heavy Fuel Oil, and bitumen through a centrally coordinated bulk procurement system.

This is hours after Ruto announced that the government will use the open tender system for procurement of its gas products, a decision set to enable consumers of gas products to access them at cheaper prices.