Facebook Piles Woes On Kenyans With Online Businesses

The enhanced credit measures will also see some advertisers being required to pay first to advertise on Facebook and Instagram.

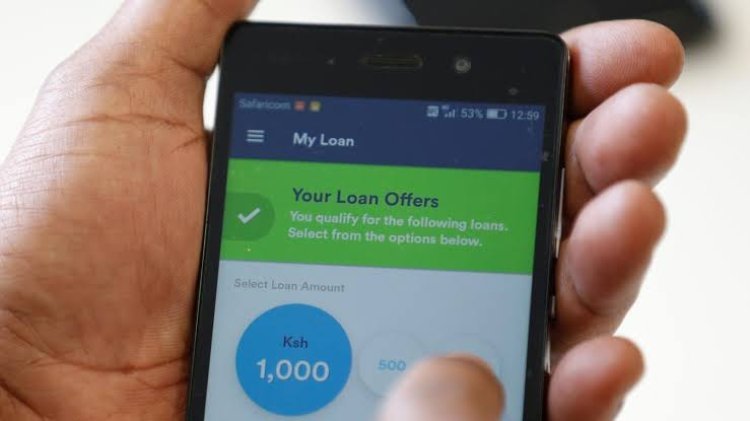

Popular social media platform Facebook, under parent company Meta, will from January 2023 reduce the powers of online businesses run by Kenyans through the platform and are on Credit Reference Bureaus (CRB).

In its updated terms to be effective from January 3, 2023, Facebook noted that it will use the CRB system to build profiles of traders’ advertising on its platforms to reduce the growing cases of defaults.

The enhanced credit measures will also see some advertisers being required to pay first to advertise on Facebook and Instagram.

The CRB checks will help Meta to monitor an advertiser’s creditworthiness ahead of labelling them as invoiced or non-invoiced.

“By placing an order, you authorise us to obtain your personal and/or business credit report from a credit bureau, either when you place an order or at any time thereafter,” says Meta in the updated terms of service.

“Non-invoiced clients are those who must make payments at the time of purchase itself. In its sole discretion, Meta may classify clients as invoiced clients based on factors such as ad spend and creditworthiness.”

Meta added that it will start levying interest at one per cent per month on overdue payments from its advertisers as part of its harsh consequences on Kenyans who advertise their services through the platforms and refuse to pay on time.

“If your payment method fails or your account is past due, we may take additional steps to collect past due amounts.

"You will pay all expenses associated with such collection, including reasonable legal fees. Past due amounts will accrue interest at one per cent per month or the lawful maximum, whichever is less,” says Meta.

The company will at the same time share information on Kenyan online businesses with the Kenya Revenue Authority (KRA) and the Kenya Police, meaning entrepreneurs using the platform to advertise or sell their products will automatically offer their consent for sharing of dealings of the business persons to a governmental entity or body.

During a joint presser between two local banks and a mobile network provider at Norfolk hotel, President William Ruto announced that by the start of November, up to five million Kenyans will be taken off the CRB blacklist, a move he termed as important because Kenyans have been blocked from borrowing loans to sustain themselves.

"I’m very happy that between 4-5 million Kenyans will, by the beginning of November. be out of the CRB blacklist. This is very important because these Kenyans have been excluded from any formal borrowing and have been left at the mercies of shylocks that exploit them," he said.

The Head of State however noted that he was not against credit listing platforms but added that they would work together to provide a platform that favours all stakeholders and does not sideline a section of people.

"The government is not against credit listing. In fact we support CRBs as a mechanism. What we are asking is we don't want credit listing to be all-or-nothing. We want it to be a platform where everyone is doing their best. Instead of people being in or out there is a credit rank where people can rise," he stated.

"Instead of blacklisting, we can have a graduated mechanism. That happens even when we borrow money from IMF so it is a positive development for Kenyans."

President William Ruto greets his Deputy, Rigathi Gachagua at the Mashujaa Day celebrations at Uhuru Gardens on October 20, 2022. /STATE HOUSE KENYA