Blow To Matatu Owners As SK Macharia's Directline Assurance Stops Issuing Insurances

The latest move as reported by Citizen TV deals a major blow to matatu owners seeking insurance for their vehicles in the event anything unfortunate happens to them during their operations.

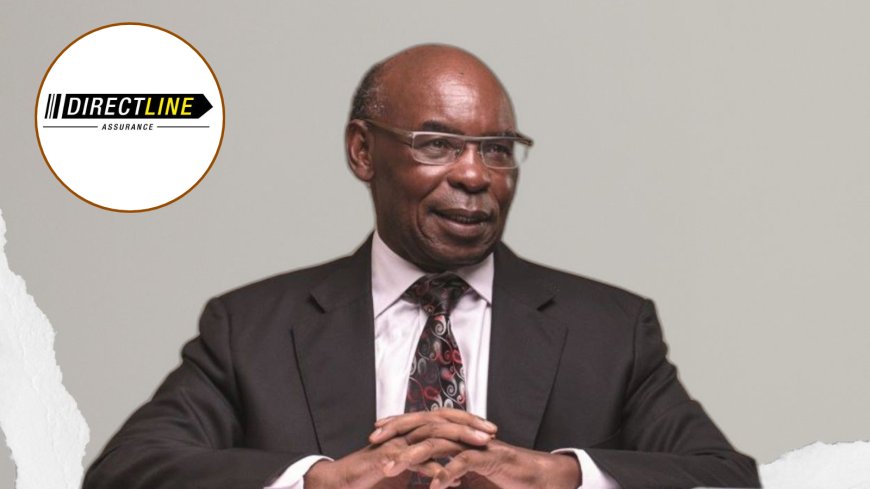

Kenyan insurance giant Directline Assurance, holding the "lion's share" of the motor commercial Public Service Vehicle (PSV) market, has announced that it will stop issuing insurance services with immediate effect.

The latest move as reported by Citizen TV deals a major blow to matatu owners seeking insurance for their vehicles in the event anything unfortunate happens to them during their operations.

On Tuesday, September 10, the company announced that the decision was reached after fraudsters infiltrated the back doors, claiming to be the shareholders of the company.

Consequently, the Association of Kenya Insurers (AKI) has been directed not to issue any insurance documents under the name of Directline Insurance Company starting immediately.

View of a matatu stage in Nairobi. /FILE

Furthermore, all banks in partnership with Directline have been informed that the ownership documents of the company, specifically the CR12 forms being circulated, are counterfeit.

Also, the banks are not authorized to conduct any transactions that have not been approved by the legitimate shareholders, who are Royal Credit Limited, SK Macharia, and Mrs. Macharia.

The company’s shareholders have accused the Insurance Regulatory Authority (IRA) of allegedly approving and continuing to approve the issuance of the counterfeit CR12 documents, despite being aware of the fraud that has been occurring since 2005.

They mentioned that the counterfeit CR12 document has been used to mislead the court into making decisions that undermine the rights of the legitimate shareholders of the company.

Additionally, those mentioned in the counterfeit CR12 document are neither shareholders nor directors of the company according to SK Macharia and his team.

IRA is yet to immediately respond to the accusations, the same regulator which on June 11, 2024, revoked the closure of the insurance giant. IRA Chief Executive Officer and Commissioner of Insurance, Godfrey Kiptum, noted that it took note of communication released by Dr S. K. Macharia through Royal Credit Limited regarding the operations of the insurer.

"The purported actions are null and devoid of any legal effect and as such the insurer continues in full operation as licensed and approved by the Authority," read the statement in part, adding "The purported transfer of the assets of the insurer to any third party is therefore null and void ab initio."

Furthermore, all policies issued by Directline Assurance Company Limited were to remain in full force and effect and the insurer remains liable for any claims arising therefrom. All policyholders of the insurer were thus directed to continue with their operations in accordance with their insurance contracts.

Beforehand, Macharia's move to shut down the insurance firm put hundreds of jobs on the line as all employees were terminated with immediate effect and the board of directors was dissolved.

The company also announced that it would cease issuing insurance, a move that threatened to ignite a crisis in the country's matatu industry given that it is heavily depended on by Kenyan matatus.